[ad_1]

Remember the Pythagorean theorem? If you just broke out in a sweat, trying to bring back your Grade 12 math, we feel you: math is kind of ‘that kind’ of 4-letter word for a whole heckuva lot of people. But if you own a business, you can’t stick your head in the sand about some really important calculations—like how to calculate margins.

Understanding profit margins is super important for small businesses. They help you figure out how much money you’re actually making after covering all your costs. Think of profit margins as the lifeline of your business—they show how efficiently you’re turning revenue into profit.

In this article, we’ll break down what profit margins are, how to calculate margins, and ways to boost profits. By the end, you’ll have the know-how to tackle your financial decisions and grow your profits.

Pick up your calculator and let’s do some math. We promise to make it painless.

What is a margin?

The first thing you need to understand is what a margin is. A margin is basically the difference between how much you sell a product or service for and how much it costs you to produce it. It’s like a snapshot of your profitability.

Margins are shown as a percentage, giving you an idea of how much profit you’re making on each dollar of sales. For example, if you sell something for $100 and it costs you $70 to make, your margin is $30, or 30%. Different margins, like gross, operating, and net, give you insights into different parts of your business’s financial health.

Are margin and profit the same thing?

It’s easy to get margins and profits confused because they give you the same information, just in different formats. Profit is the actual amount of money you make written as a dollar amount. Margin is a percentage that shows how much of each dollar of sales is profit. Think of profit as the dollars in your pocket and margin as how efficient a business is at making those dollars.

What are the benefits of knowing your margins?

1. Margins help you make good decisions in your business

Knowing your margins can help you make informed decisions about how to price your products or services, how to control costs, and how to allocate resources. You’ll be able to easily figure out what products or services are the most profitable and double down on them to bring in even more profits. This way, you’re not just guessing—you’re making strategic moves that move that bottom line.

2. Get insight into your business’ financial health

Understanding your margins gives you an overall clear picture of your business’ financial health. It helps you track profitability trends over time so you can make adjustments to either maintain or improve profits. It’s like having a financial health check-up whenever you need it.

3. Give yourself a leg up on the competition by reviewing margins

Are you struggling with knowing exactly what to price your products or services? Calculating your margins can help. By knowing your margins, you can price competitively without sacrificing your profits. You can respond strategically to market changes and stay ahead of your competitors. Plus, it gives you the confidence to make bold moves when needed.

4. Margins help you create better budgets and forecasts

With all of your margins calculated, you create more accurate budgets and financial forecasts. This makes sure you have the right resources in place to grow your business—whether that’s more labor or more product. For example, more knowledge about profit means you can add more staff and then add even more profits by extending your hours or offering better customer service. See what we’re getting at? With solid data, you can plan for future growth with less stress.

How to calculate margins

There are lots of different types of profit margin equations you’re going to need to know to get the full picture of your business’ finances. We’ll show you what types of margins you should calculate, how to calculate them, and give you clear examples so you can see these calculations in action. Let’s pull out those calculators.

1. Gross profit margin

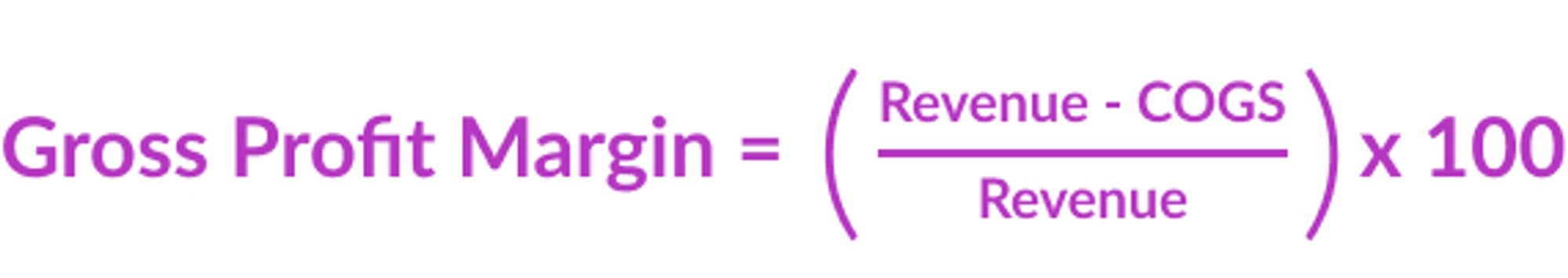

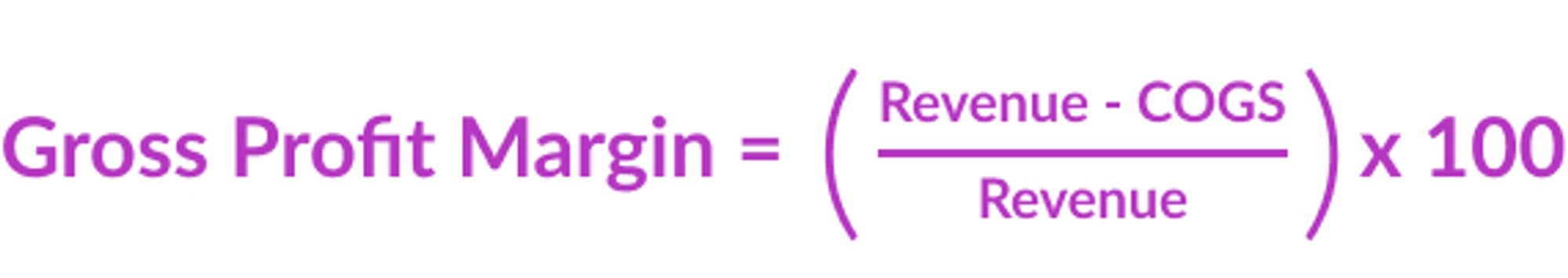

In technical terms, the gross profit margin shows the percentage of revenue that exceeds the cost of goods sold (COGS). In easier-to-understand words, it tells you how much profit your business makes after covering the direct costs of producing your goods or services.

To calculate it, you subtract COGS from total revenue and then divide by total revenue, multiplying by 100 to get a percentage.

For example, if a restaurant’s revenue is $100,000 and COGS (things like wages, food overhead, rent, etc.) is $60,000, your gross profit margin is 40%. This margin helps you understand how efficiently your business is producing and selling.

2. Operating profit margin

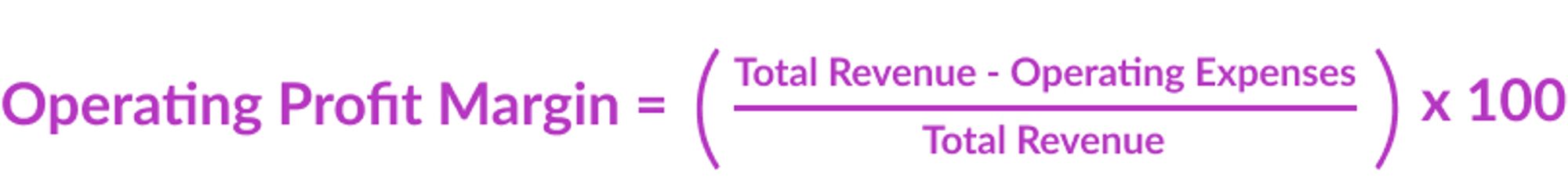

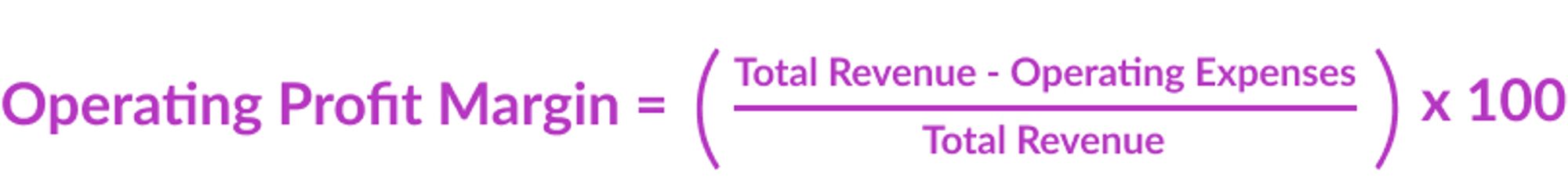

Operating profit margin is a financial metric that shows the percentage of revenue that remains after all operating expenses are deducted. Knowing your operating profit margin gives you an idea of how efficiently your business is running its core operations.

To calculate it, subtract operating expenses—like wages, rent, and utilities—from total revenue, then divide by total revenue and multiply by 100 to get a percentage.

For example, if you run a retail store and your revenue is $100,000 and your operating expenses (wages, retail product, utilities, etc.) are $70,000, your operating profit margin is 30%. This helps you understand the profitability of your day-to-day business activities.

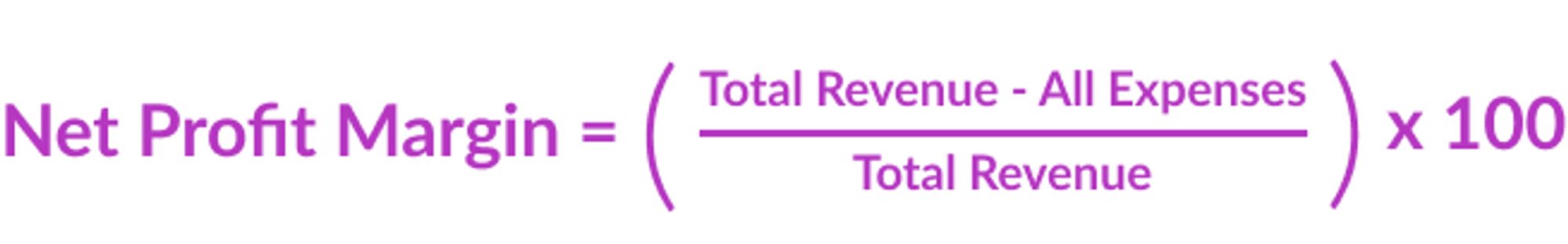

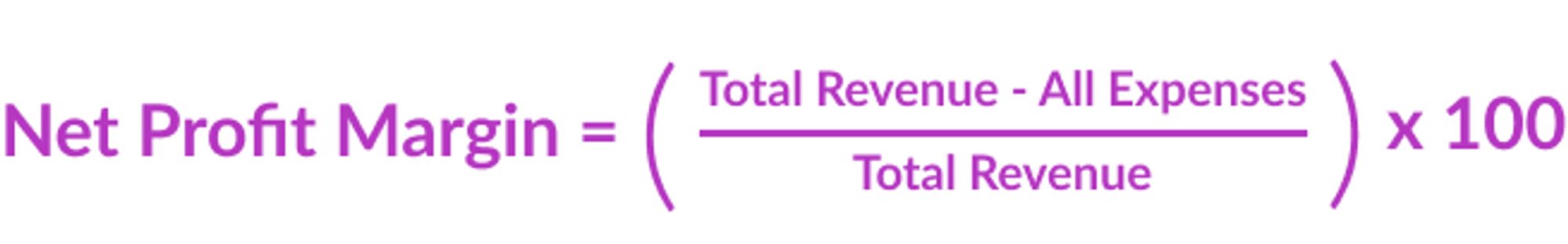

3. Net profit margin

Net profit margin is a financial metric that shows the percentage of revenue that remains as profit after all expenses are deducted. We’re talking everything from operating expenses, interest, taxes, and any other cost—big or small. The net profit margin is the percentage of money that’s left over after everything is paid for. It’s your best bet for knowing your business’s actual overall profitability.

To calculate it, subtract all expenses from total revenue, then divide by total revenue and multiply by 100 to get a percentage.

For example, if your revenue is $100,000 and your total expenses are $85,000, your net profit margin is 15%. This margin gives a complete picture of your business’s profitability after all of your bills are paid.

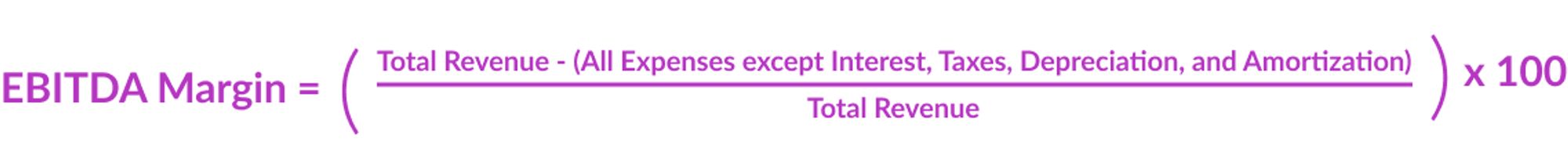

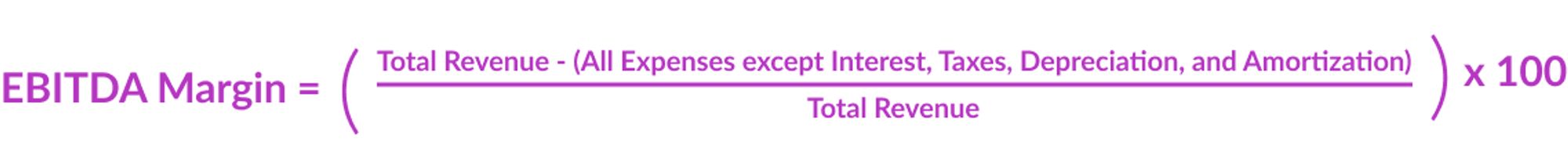

4. EBITDA margin

EBITDA margin is a financial metric that shows the percentage of a company’s revenue that is converted into earnings before interest, taxes, depreciation, and amortization. Ok. That was a lot of words. This margin calculation helps you figure out the business’ operational efficiency and profitability without the impact of financial and accounting decisions.

To calculate it, subtract all expenses except interest, taxes, depreciation, and amortization from total revenue, then divide by total revenue and multiply by 100 to get a percentage.

For example, if your revenue is $100,000 and EBITDA is $30,000, your EBITDA margin is 30%. This margin really helps you assess the core profitability of your company—and compare it to others in your industry.

What is a good profit margin?

Now that we know how to calculate all of the numbers you need, what does it all mean? What’s an actual good profit margin? Well, each industry is going to have its own standards. A restaurant is going to have much more overhead than, let’s say, an ice cream truck.

*Quick note: we’re generalizing what we’re calling our benchmarks—bad, good, better, best—but you get the idea.

Here are some general benchmarks for profit margins for small businesses:

A bad profit margin.

A bad profit margin is typically anything below 5%. This margin tells us that a business is struggling to cover its costs and may not be sustainable in the long term. People shouldn’t see this as a failure—just room for improvement. Things to look at are high expenses, low pricing, or inefficiencies in operations. If your margin is below 5%, it’s a red flag that you need to take action to reduce costs or increase revenue so you can avoid potential financial trouble in the long run. You’ve got this.

A good profit margin.

A good profit margin is in the 10% range. What this level tells us is that your business is making a reasonable profit and can sustain itself. It shows us that you have decent control over costs and a solid position in your market. Well done.

A better profit margin.

An even better profit margin sits in the 15% range. This margin shows us that your small business is thriving, and you’re generating significant profits. Now you can take those profits and reinvest them for growth, use them to pay down debt, or distribute them as dividends. Your hard work is paying off!

A very good profit margin.

Once you get into that 20% or higher range for profit margins, you’re in what we call the ‘best’ range. Hitting this margin means your business is not only thriving, but excelling. You are maximizing profitability, most likely have strong brand loyalty, and can easily handle those market fluctuations that are bound to happen. You’ve got enough wiggle room that you can start making some business decisions to help you grow, like maybe even opening a second location. Give yourself a good ol’ pat on the back.

Profit margin examples by industry.

We have generalized benchmarks for profit margins, but what are real life industries bringing in for net profit? It really does fluctuate depending on the business so let’s look at some examples for different types of businesses:

Profit margins for restaurants.

Most people know that profit margins in the restaurant industry can be tight. Operating costs are high for restaurants with food and beverage coming in and out the door all day long and with higher staffing needs. This is often why restaurants have different wage rates for their servers and why people tip. Net profit margins for restaurants sit in the 2% – 6% range.

Profit margins for retail stores.

Because retail stores have such a wide range of products, the net profit margin range is pretty big. Anywhere from 0.5% to 9%. Retail building suppliers are on the higher end of this range and smaller clothing retailers are on the lower end of this range because they just don’t have the high volume sales ability as other clothing stores.

Profit margins for hair salons.

Hair salons are another example where net profits can vary greatly. Depending on the location and services they offer, hair salons have a net profit margin of 8% to 25%. If your salon is in downtown Manhattan and specializes in color corrections, your salon will be at the higher end of that range. If your salon is in a small town and offers men’s cuts, that profit margin may be a bit lower.

How to improve your profit margin.

We’ve done the math, we’ve looked at bad, good, better, and best, and we’ve checked out some specific industry standards, but what do we actually do with all of this information? It’s time to put this data into action by improving margins. Here are some ways you can improve your margins:

1. Increase your prices.

You may be saying, duh, but we know this can be a tricky one for business owners. Raising your prices, even just a bit, can really boost your profit margin. Look at what your competitors are charging and think about the unique value you offer. Make sure to explain this value to your customers so they understand why prices are going up. It’s a balancing act, but done right, you’ll see higher revenue without losing loyal customers.

2. Reduce your costs and improve efficiency.

Cutting down expenses without skimping on quality is key. Look for areas where you can cut waste or get better deals with suppliers. Maybe switch to more cost-effective materials or find more efficient ways to operate. For example, save on employee hours by automating repetitive tasks like using payroll software that does everything for you. Every dollar saved on costs is a dollar added to your profit.

3. Get creative to boost your sales.

Increasing your sales volume helps that bottom line. If you’re saying in your head, ‘I’ve tried to boost sales and it doesn’t work’, let’s get creative. Try new marketing campaigns, loyalty programs, or special promotions to attract more customers. Ask your employees if they have any creative ideas to bring in more sales— after all, they hear from customers every day. More sales mean better profit margins.

4. Negotiate better deals.

Don’t underestimate the power of building strong relationships with suppliers. If they know you’re a regular customer, they’re more likely to offer better terms and discounts. Regularly review your contracts and shop around to make sure you’re getting the best deals. Lower input costs are going to have a direct effect on your profit margins.

What to do with profit margin information.

Understanding and calculating profit margins might not be the most glamorous part of running a business, but it’s totally necessary. Profit margins give you a clear picture of how well your business is doing and where you might need to make some adjustments. Think of them like vital signs of your business’ financial health.

By knowing how to calculate all different types of margins—and knowing what it all means—you can make smarter decisions that drive your business forward. Whether it’s tweaking your pricing, cutting costs, or finding new ways to boost sales, focusing on your margins can help you turn your business into a well-oiled—and profitable—machine.

So, keep that calculator handy and make those numbers work for you. Here’s to higher profits and a thriving business.

Stop chasing down phone numbers with our built-in team communication tool. Message teammates, share updates, and swap shifts — all from the Homebase app.

[ad_2]