[ad_1]

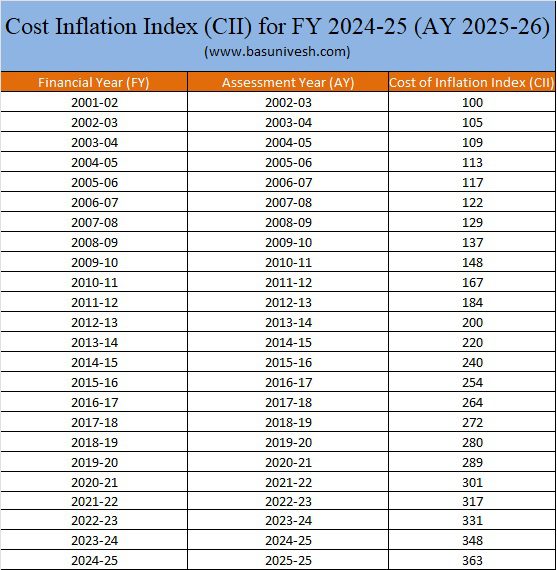

What is the Cost Inflation Index (CII) for FY 2024-25 (AY 2025-26)? CBDT notified Rs.363 as the Cost of Inflation Index for FY 2024-25 (AY 2025-26) on May 24, 2024.

The cost of products rises as time goes on, leading to a decrease in the buying power of money. For instance, if Rs 1,00,000 could purchase two units of goods today, tomorrow the same amount might only be able to buy one unit due to inflation. The Cost Inflation Index (CII) is utilized to calculate the escalation in prices of goods and assets annually as a result of inflation.

In the Budget 2017, the Government proposed a modification in the base year for calculating the indexation benefit. Previously, the base year was set at 1981, but now it has been changed to 2001. It is important to note that this change applies to all asset classes, but the impact will vary depending on the assets that enjoy indexation benefits for long-term capital gains, such as real estate, unlisted shares, gold, and bond funds.

Before 31st March 2017, the capital gain was determined using the purchase price based on the fair market value of 1981. This meant that for assets purchased before 1st April 1981, the purchase price could be calculated using the fair market value of 1981. However, starting from 1st April 2017, the purchase price will be calculated using the fair market value of 2001. Consequently, capital gains on assets acquired before 1st April 2001 will also be calculated using the fair market value as of 2001.

What is the Cost Inflation Index (CII)?

It is a metric for inflation utilized in the calculation of Long Term Capital Gains (LTCG) from the sale of capital assets according to IT Section 48. This metric is declared annually for each Financial Year.

Therefore, the applicable CII rate will correspond to the specific financial year in question. Calculating the LTCG is crucial in determining a capital gain, and the Cost of Inflation Index (CII) is essential for this purpose. An example can illustrate how the indexed cost of acquisition is computed using the CII.

Indexed Cost of Acquisition=(Cost of Acquisition/Cost of Inflation Index (CII) for the year in which the asset was first held by the assessee OR FY 2001-02, whichever is later)* Cost of the Inflation Index (CII) for the year in which the asset was sold or transferred.

Let us assume that you purchased the property in FY 2005-06 at Rs.50 lakh and sold the same in FY 2017-18 at Rs.1.5 Cr. Now the indexed cost of acquisition will be as per the above formula i.e.

Indexed Cost of Acquisition=(Rs.50 lakh/117)*272=Rs.1,16,23,931. So the Long Term Capital Gain=Selling Price-Indexed Cost of buying property = Rs.33,76,069.

(Note- As per the below Cost of Inflation Index (CII), the CII rate for FY 2017-18 is 272, and for FY 2005-06, it is 117).

However, neglecting the indexed cost would result in a straightforward gain of Rs.1 crore (Rs.1.5 crore – Rs.50 lakh). However, when it comes to taxation, the Long-Term Capital Gains (LTCG) on capital assets will be calculated after adjusting the purchase cost for inflation using the Cost of Inflation Index (CII).

Cost Inflation Index (CII) for FY 2024-25 (AY 2025-26)

Let me share with you the Cost Inflation Index (CII) from FY 2001-02 to FY 2024-25.

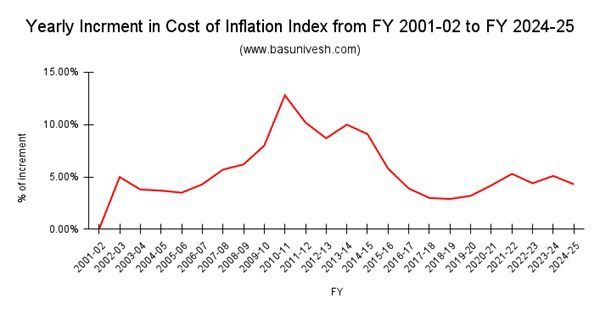

Now let us see how this cost of inflation index is increasing year on year from the base year to the latest FY 2024-25.

You noticed that from last year to this year, the increment is around 4.3%. Hope this information will help you in arriving at your capital gain tax.

[ad_2]