[ad_1]

I use the free Fidelity retirement planning tool to keep an eye on our current investments relative to our spending. Using that tool revealed two fundamental drivers of financial success in retirement.

| Good Returns | Bad Returns | |

|---|---|---|

| Low Spending | OK | OK |

| High Spending | OK | Not OK |

Although my wife said the two fundamental drivers were only too obvious, the planning tool gives us an idea of how low is low and how high is high.

Conventional Retirement Calculator

The Fidelity retirement planning tool uses a conventional approach. It gathers your investments and asks you how much you plan to spend. Then it simulates future returns to see how well your investments will cover your planned spending. It’s a success if your projected balance is above zero at the end of your planning horizon. Many retirement planning tools work like this. I just happen to use the one from Fidelity because it’s available and free.

It isn’t easy to use the tool to model big financial decisions such as staying in a high-cost-of-living area after retirement versus relocating as we did last time in Moving to Lower Cost of Living After You Retire. You can run the projections and save the report as a PDF, change the assumptions, run it again, save the new report as a PDF, and compare the two PDFs. If you’d like to go back to your original assumptions, you must remember where you made changes and back out all your changes.

When I compare the effects of different levels of spending, I use my login to run one level of spending and my wife uses her login to run a different level of spending. Then we compare the two PDFs. It works for a simple A-B comparison but it’s difficult to do more than that.

MaxiFi

Other financial planning applications are better equipped for tactical planning. MaxiFi is one of them.

MaxiFi is online financial planning software from a company led by Boston University economics professor Larry Kotlikoff. The Standard version costs $109 for the first year ($89/year for renewal) and the Premium version costs $149 for the first year ($109/year for renewal). I bought the Premium version last year to see how it worked.

I played with the software but I’m not a power user. Reader Dennis Hurley is more experienced with MaxiFi. He helped me get up to speed. I’m only describing how I used MaxiFi. It may not be the officially correct way as intended by the software maker. I’m not paid by MaxiFi or anyone else to write this review. I don’t benefit financially in any way if you buy MaxiFi or any other software.

MaxiFi takes an unconventional approach. It doesn’t link your accounts. It only asks for the total amount in your pre-tax, Roth, and taxable buckets. It doesn’t ask what investments you have in your accounts. You enter your expected safe return for each bucket in the settings. It doesn’t ask how much you plan to spend unless it’s one-time or episodic (“special expenses”). The software calculates your available discretionary spending based on the principle of consumption smoothing.

Discretionary spending in MaxiFi is in economic terms. It isn’t what we normally think of as discretionary in everyday life. MaxiFi treats housing, taxes, Medicare Part B premiums, life insurance, and special expenses as fixed spending. Everything else is discretionary spending. You would think food isn’t discretionary but that’s just how MaxiFi categorizes things. If the term “discretionary” bothers you, just give it a different name or simply call it “other.” Discretionary spending in MaxiFi represents a living standard.

Base Plan and Maximized Plan

MaxiFi starts by asking about your current financial situation and your assumptions for inflation, expected returns, your desired retirement age, when you will start withdrawing from your retirement accounts, and when you’re thinking of claiming Social Security. This generates a Base Plan.

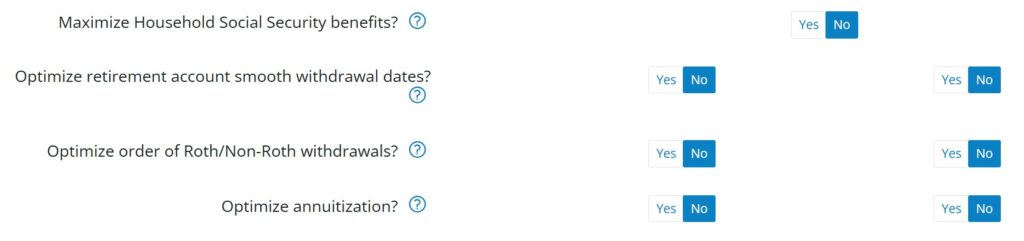

Then it offers to improve the Base Plan by automatically testing changes to when you will claim Social Security, when you will start smooth withdrawals from your retirement accounts, whether you’ll withdraw from pre-tax accounts first or Roth accounts first, and whether you’ll consider buying an annuity.

You can say yes or no to which item you want the software to change. MaxiFi will generate a Maximized Plan by testing different combinations of those items and picking a plan that has the highest lifetime discretionary spending. If you’re happy with the changes, you can apply them to the Base Plan in one click.

Discretionary Spending as a Metric

MaxiFi sees a change as an improvement when it increases the calculated discretionary spending. I treat the annual discretionary spending from MaxiFi only as a metric. I see it as a living standard available to me, not as the software mandating that I must actually spend that amount every year. I only use the amount of discretionary spending to compare different situations. I know that a move is a good one if it increases my available discretionary spending.

Social Security Claiming Strategy

If you’re married and you set the maximum age to 98 or 100 for both of you, MaxiFi will most likely suggest that you both delay claiming Social Security to age 70. Don’t be surprised when you see it differs from the output of other tools such as Open Social Security.

Open Social Security uses mortality tables with weighted probabilities of living to different ages. MaxiFi uses fixed ages from your inputs. If you say both of you will live to 100 for sure, the best strategy naturally is to delay to age 70 for both. You’ll see different strategies when you create different profiles with both spouses living to 85 or one spouse living to 95 and the other living to 83, etc. I like Open Social Security’s approach better in this regard.

The maximum age inputs also affect annuity suggestions in the Maximized Plan. If you say both of you will live to 100 in the profile, buying an annuity will naturally be helpful if you turn on optimizing annuities. I set the annuity options to “no” when I run a Maximized Plan.

Assumptions, Assumptions, Assumptions

MaxiFi is a modeling tool. It can’t predict the future. No software can. All outputs are based on a specific set of assumptions. I automatically add “based on this set of assumptions” to every output I read from MaxiFi.

The Maximized Plan is optimal only based on one set of assumptions. The optimal plan will be different under a different set of assumptions. I see the value of MaxiFi not as much in generating a withdrawal and spending plan based on a set of assumptions but more in testing different assumptions.

Alternative Profiles

MaxiFi makes it easy to compare different scenarios. You duplicate the Base Profile into an Alternative Profile, make changes in the Alternative Profile, and compare it with the Base Profile. You can have up to 25 alternative profiles and compare between different profiles. This helps answer all sorts of “Can I afford it?” and “Should I do A or B?” questions:

Can I retire now versus 5 years from now?

Can I afford to buy an expensive house or a second home?

Will helping my kids derail my retirement?

Should I sell investments and realize capital gains to pay cash for a home or get a loan?

Should I stay in my current home or downsize or relocate?

Should I sell my house or rent it out because my mortgage is below 3%?

These big financial decisions require more attention because they tend to be one-time, all-or-nothing, and costly to switch.

You’ll see the impact on your available discretionary spending when you compare outputs between alternative profiles. You know you’ll have more money to spend if you work another 5 years, but by how much? You create one profile with retiring now, duplicate it, change the retirement date, and compare. You know you’ll have less money for retirement if you help your kids or grandkids, but by how much? You duplicate your current profile into an alternative profile, add the extra expenses, and compare it with your current profile.

Example

A reader said he was interested in moving from a high cost-of-living area but selling his home will trigger taxes on a large capital gain well beyond the $500k tax exemption. The NYT buy-or-rent calculator I used in the previous post doesn’t take into account the built-in capital gain. MaxiFi does.

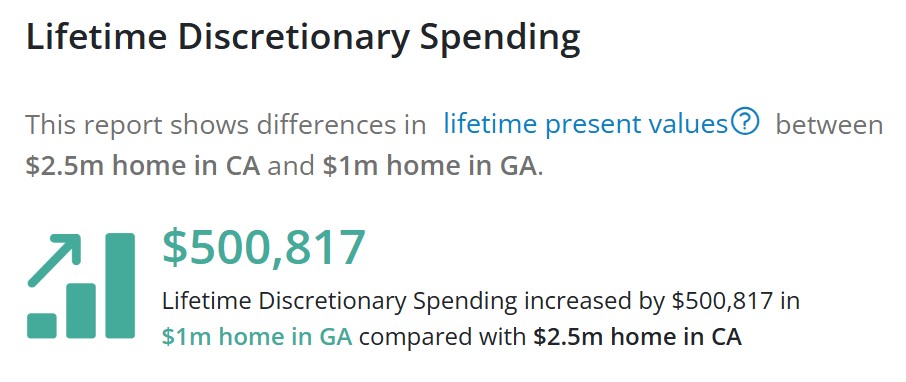

I created one hypothetical profile in MaxiFi with a home in California worth $2.5 million having a cost basis of $500k ($2 million unrealized capital gain before the tax exemption). I duplicated it into another profile and made changes to sell the home in California, pay federal and state taxes on the capital gains, and buy a $1 million home in Georgia. MaxiFi shows this when I compared the two profiles:

It shows how much the lifetime discretionary spending would increase based on a set of assumptions by selling the California home and moving to Georgia despite having to pay capital gains taxes on $2 million. I can create additional profiles and compare again with the home value growing faster in California than in Georgia or different inflation rates and different investment returns.

MaxiFi can’t predict the future but it can help you model different scenarios.

Roth Conversions

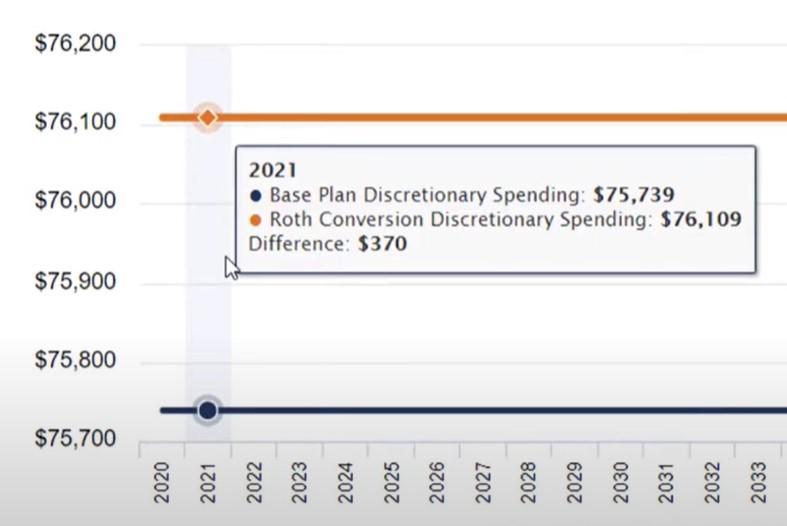

You can also use alternative profiles to model Roth conversions. MaxiFi doesn’t suggest how much you should convert but you can test converting different amounts between age X and age Y in alternative profiles. Here’s a video from MaxiFi on how to model a Roth conversion:

Ignore the Precision

Any modeling software will calculate to the exact dollar but I ignore the precision. Because projections are based on assumptions, it will be a miracle if a projection gets the first two digits correct in real life. It’s difficult to even get the first one digit right.

In the previous example, if a retired couple sells a $2.5 million home in California and moves to Georgia, will they really increase their lifetime discretionary spending by $500,817? It could turn out to be $300k, $400k, $600k, or $700k. I don’t think you can have high confidence it’ll be $500k in real life. All you can say is that selling and moving is directionally beneficial if the assumptions aren’t too far off.

The Roth conversion video from MaxiFi shows that the conversion amount being considered would raise the annual discretionary spending from $75,739 to $76,109 based on a set of assumptions. I would call this result a toss-up. The $370 difference is too small because it’s less than 0.5% of the annual discretionary spending. Converting that amount in real life could be better or it could be worse. I can’t even say it’s directionally beneficial. I would look for moves that make a bigger difference.

Monte Carlo

The Premium version of MaxiFi includes Living Standard Monte Carlo®, which simulates how different investment strategies and spending behaviors impact your living standard. The $40 price difference between the Stand version and the Premium version in the first year isn’t much. You might as well get the Premium version to see if the Monte Carlo reports are helpful but I find the standard reports more useful than the Monte Carlo reports.

A problem with Monte Carlo is that it always shows a wide range of outcomes. My available spending can be $50k a year if returns are poor or it can be $200k a year if returns are good. So do I spend $50k or $200k? If I spend $50k a year and returns aren’t that bad, I’ll have a ton of money left that I could’ve enjoyed. If I spend $200k a year and returns are poor, it won’t be sustainable. This isn’t unique to MaxiFi. That’s just the nature of the beast. No software can remove this uncertainty.

I find more value in the reports in the Standard version of MaxiFi because I only use the annual spending from the software as a metric to compare different scenarios. I don’t go by the spending output from the software for my actual spending. If you want to save a little bit of money, maybe start with the Standard version and upgrade to Premium when you decide to use MaxiFi long term.

Support

MaxiFi has a user’s manual on its support website and how-to videos and webinars on YouTube. The company also offers online office hours twice a month to answer questions. If you can’t figure out how to model something, you can send an email to MaxiFi customer service and they’ll tell you. If you want a MaxiFi expert to review your plan and help you interpret the results, it’s $250 for a one-hour video session. I get the sense that they really want to help you make good financial decisions with the software.

Other Software

I’m satisfied with MaxiFi overall. It’s inexpensive and useful to model big financial decisions. No software can predict the future or remove uncertainty but you don’t have to throw up your hands and leave big financial decisions to gut feelings.

It’s unrealistic to expect any software to give you a withdrawal plan that won’t lead to having a big pile of money at the end when returns are good or having to adjust the spending down when returns are poor. That’s not how I use MaxiFi.

Set a wide range of assumptions and evaluate the wide range of outcomes. You still won’t know how exactly a big financial decision will turn out in real life but you’ll have some idea of a range and understand what will influence the outcomes. It’s a steal to pay only $109 or $149 for a tool to help you make big financial decisions that are one-time, all-or-nothing, and costly to switch.

MaxiFi isn’t the only financial planning software. I can’t say it’s the best because I haven’t used many other software to compare. I only know it’s more powerful than the free Fidelity retirement calculator. NewRetirement and Pralana are in the same $100 – $150 price range. If you have big financial decisions coming up and you’re not sure which software to use, try them all and pick your favorite. I’m going to buy Pralana to try it when my MaxiFi license expires.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

[ad_2]