[ad_1]

Ruchi is a News Reporter covering the US stock market. She has been following and analyzing American public companies for more than 15 years.

Updated on

Reviewed by Steve Rogers

Steve Rogers has been a professional writer and editor for over 30 years, specializing in personal finance, investment, and the impact of political trends on financial markets and personal finances.

Food is one of the most visible items in the average American budget. We eat daily and shop for food frequently. Groceries are also one of the more flexible items in a budget: you can’t change your rent or car payment, but you can shift your grocery shopping patterns. Let’s look closer at the average cost of groceries and how it varies with location, income, and family size.

Groceries are usually defined as food items that are prepared and consumed in the home. Money spent on eating out or ordering out doesn’t qualify. Consumable items often purchased in grocery stores, like cleaning supplies and personal hygiene items, may also be classified as groceries.

Average Monthly Food Spending

Here’s a breakdown of the average American monthly spending pattern. Food is the third largest expense, but it’s not broken down into groceries and food prepared outside the home.

Food spending includes groceries and food away from home, which is any food that you pay someone else to prepare for you. On average, Americans spent $779 per month on food in 2022 and $9,343 over the full year. Here’s how that breaks down.

How Much Does an Average American Spend on Groceries Each Month?

When considering only grocery expenses, the average American spends about $475 monthly and a total of $5,703 throughout the year.

💳 Learn more: Maximize your savings on daily essentials with our guide to the best credit cards for groceries.

How Much Do Americans Need to Spend on Groceries

Are Americans spending more than they need to spend on groceries?

The US Department of Agriculture has created four food plans that Americans can follow; the Thrifty Plan, the Low-cost Plan, the Moderate-cost Plan, and the Liberal Plan[1].

These plans take into consideration the age and gender of a person to calculate the average food cost. The plans are built on the assumption that all meals are cooked at home and meet nutritional recommendations. Figures are updated regularly to account for inflation.

Here are the average food costs listed in the December 2023 USDA Food Plan[2,3]:

The average monthly grocery bill of a family of two adults and one five year old child in the US following the official USDA moderate food plan is $898. That’s substantially higher than the average household food expenditure of $779. The disparity is because many American households don’t have children, which brings down the average expenditure.

US Census data indicates that the average family household size is 3.2 people, while the average non-family household size is only 1.25 people. The average food expenditure is not broken down by family and non-family households, but family households will have substantially higher food expenditures than non-family households.

Higher Income Earners Spend More on Groceries

Income has a major impact on grocery spending. Unsurprisingly, a higher income rolls out a smorgasbord of options. People with higher incomes can afford to pay more for organic produce, imported foods, and gourmet items[4].

Low incomes also influence overall choices. According to a 2019 study, lower-income households purchase fewer healthy foods like vegetables and dairy products than households with a higher income. The study noted that “lower-income households had lower (poorer nutrition quality) scores compared with higher-income households”.

Low-income households also pay more for the food they buy. Consumers can save significant amounts by buying non-perishable items in bulk, but a tighter budget puts money-saving bulk purchases out of reach. Low-income households shop online less frequently, and they have less access to large grocery stores with competitive pricing.

How Has the Cost of Groceries Changed Over the Years?

Average food expenditures for both food prepared at home and food ordered outside the home have increased steadily for many years, with a particularly sharp jump during the high inflation period of 2022[4].

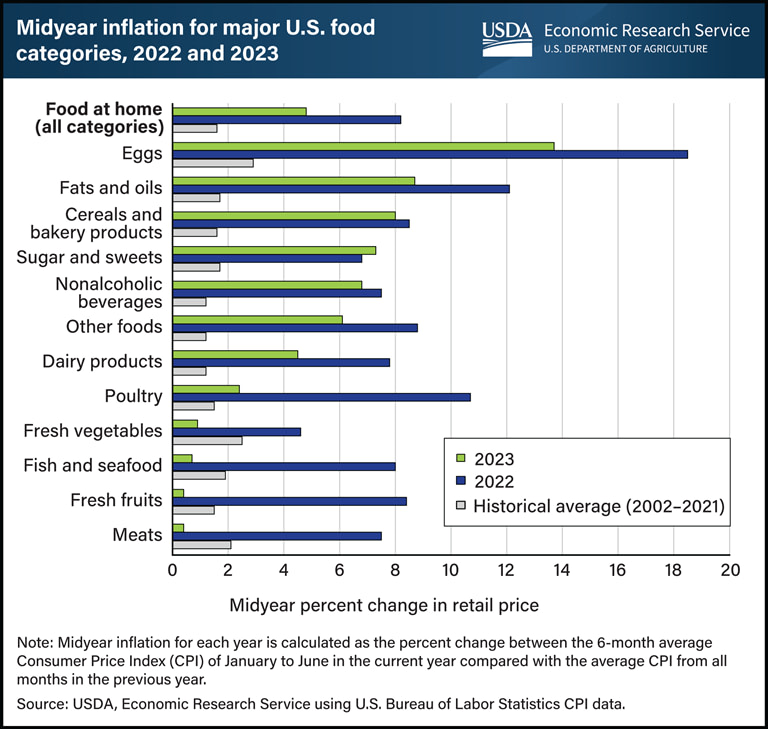

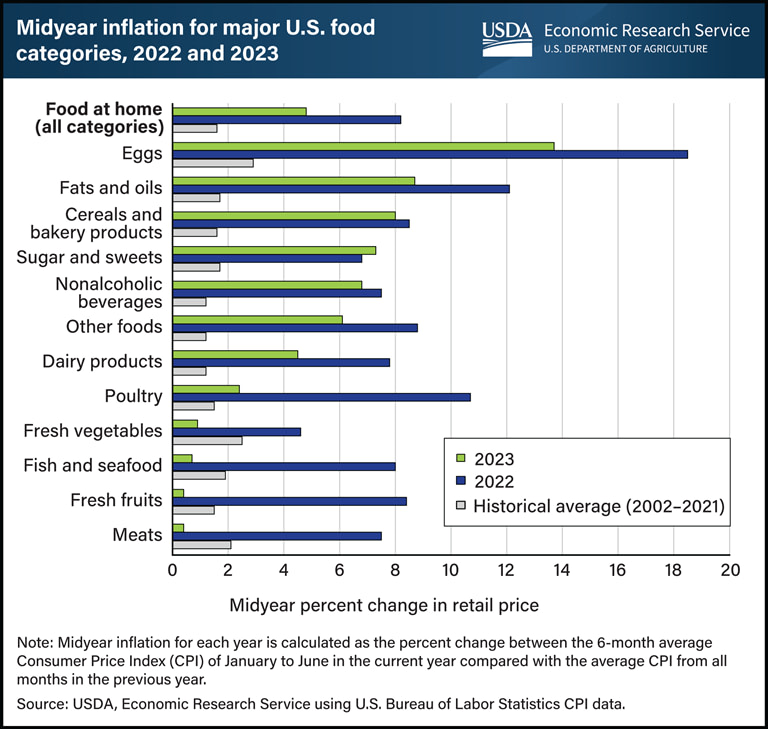

Food prices increased sharply during the inflation surge in 2022. Food price inflation abated somewhat in 2023 but was still well above historical averages.

Egg and poultry prices were hit by an outbreak of Highly Pathogenic Avian Influenza (HPAI). Egg prices had the largest price increase (32.2%) between 2021 and 2022 of any category tracked by USDA. Beef and veal prices increased the least (5.3%) between 2021 and 2022 and generally declined from peak prices in November 2021.

The USDA predicts that food-at-home prices will drop 0.6% in 2024, with food-away-from-home prices forecast to rise 4.9%[5].

The Average Cost of Groceries by State

The average cost of groceries varies considerably by state. Hawaii and Alaska typically see the highest costs, as many goods have to be shipped over large distances[6].

Conclusion

Income is a fundamental factor influencing household spending on groceries. Higher income allows households to allocate more money for food and other expenses. High-income households may have the flexibility to choose premium and organic products, contributing to a higher overall grocery bill.

Lower-income households often face budget constraints, leading them to make cost-conscious choices. Dietary choices, cultural preferences, and lifestyle decisions influence the types of food items people purchase.

Household grocery spending is a complex outcome influenced by a combination of factors, including income, demographic characteristics, location, preferences, economic conditions, and external events. Understanding these factors helps policymakers, businesses, and individuals make informed decisions about budgeting, resource allocation, and responding to dynamic market conditions.

Ruchi is a News Reporter covering the US stock market. She is located in India but has been following and analyzing American public companies for more than 15 years. Previously, she worked at Businessday Nigeria and has written content for Insider Monkey and Zacks Investment Research.

The content on finmasters.com is for educational and informational purposes only and should not be construed as professional financial advice. Finmasters is not a financial institution and does not provide any financial products or services. We strive to provide up-to-date information but make no warranties regarding the accuracy of our information.

wpDiscuz

[ad_2]