[ad_1]

Posted by sean

Today’s show is brought to you by Teucrium

![]()

We had Sal Gilbertie, CEO of Teucrium on the show to get an update on the global commodity market.

On today’s show, we discuss:

- Utilizing the cost of production with commodities

- How inflation affects commodity prices

- What is involved within the cost of production equation

- How oil is affecting commodity prices, and an update on oil moving forward

- How monetary policy has affected the world of commodities

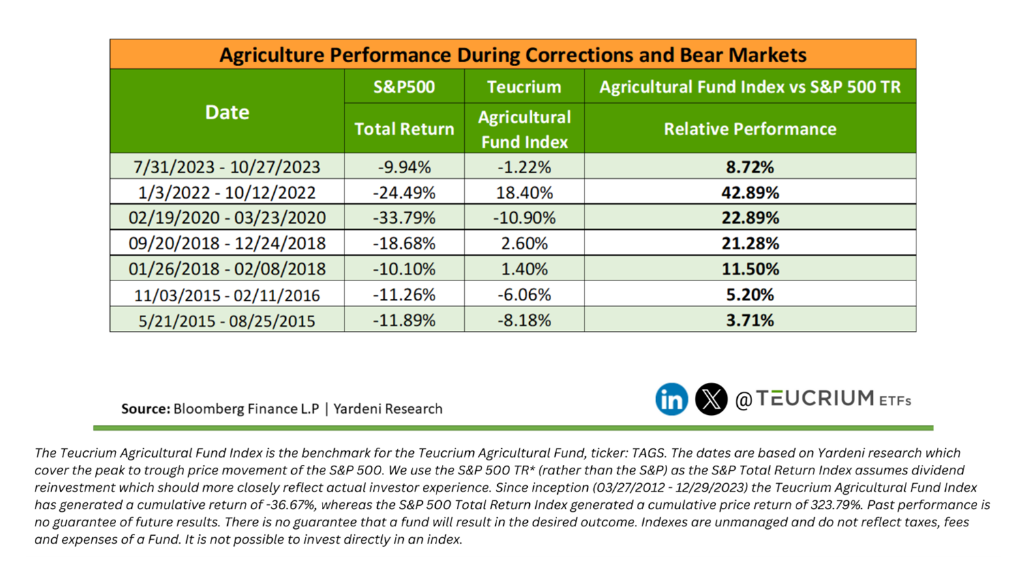

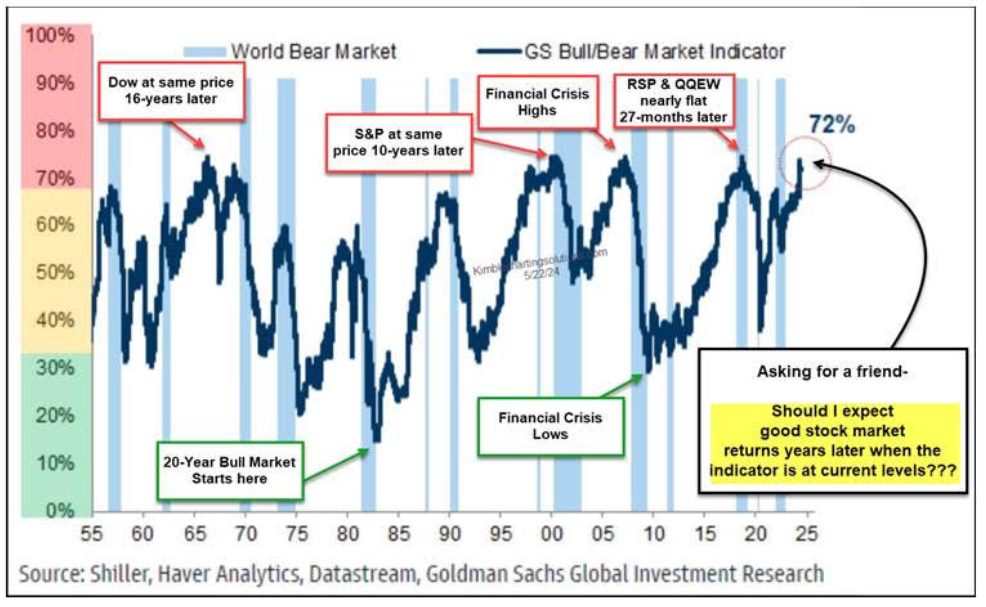

- Correlations between commodities and stocks

- Pros and cons of utilizing a K1 for commodity trading

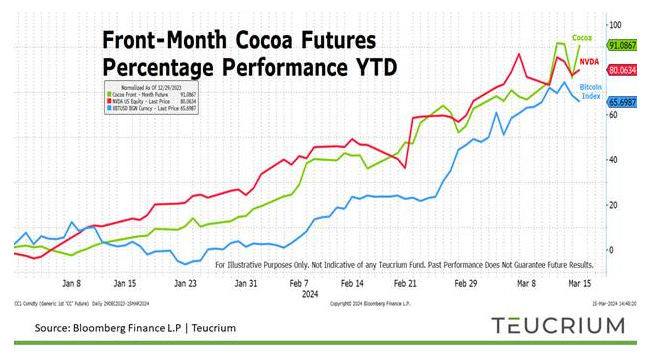

- What’s going on with Cocoa prices

- How technology may affect commodities

Listen here:

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

The Compound Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

[ad_2]