[ad_1]

Selling a short box spread is a way to get a loan at a good rate using your investments as collateral. I sold some short box spreads to get cash for building a home because I didn’t want to sell stocks when stocks were down. Now that stocks recovered, I sold stocks to close out the box spreads before the expiration date.

When you close out a box spread early, you may end up with a gain or loss depending on the interest rate changes. The interest rate happened to have gone up since I originally sold the short box spreads. I ended up with a small gain.

The broker will include the realized gain or loss on a 1099-B form. See Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA for how to report it on your tax return.

Here’s how I closed out my short box spreads early.

Close Out a Short Box Spread

I executed these trades when I originally sold the box spread:

- Sell to Open a call on SPX in December 2027 at 4,300

- Buy to Open a call on SPX in December 2027 at 5,000

- Buy to Open a put on SPX in December 2027 at 4,300

- Sell to Open a put on SPX in December 2027 at 5,000

Sell – Buy – Buy – Sell.

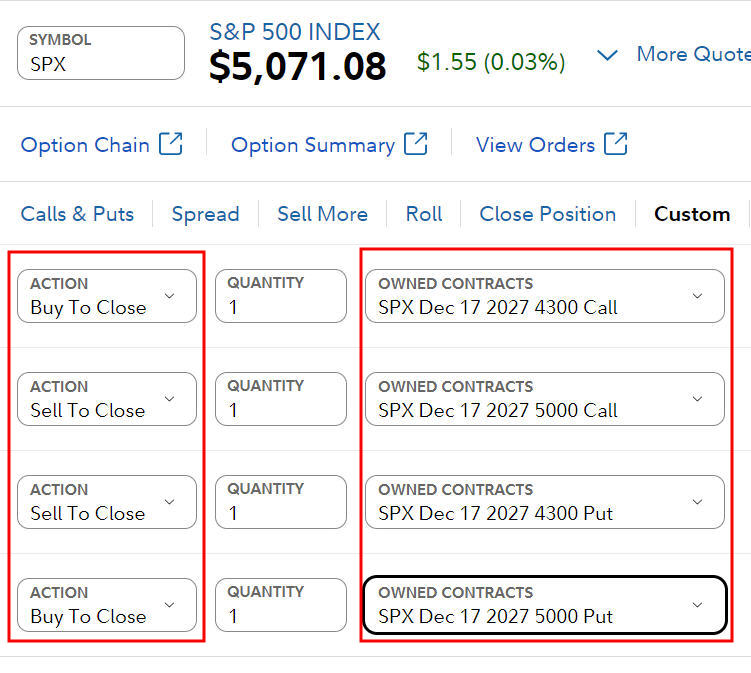

To close out this box spread, I needed to execute trades in the opposite direction. “Sell to Open” becomes “Buy to Close” and “Buy to Open” becomes “Sell to Close.” Therefore, these are the closing trades:

- Buy to Close a call on SPX in December 2027 at 4,300

- Sell to Close a call on SPX in December 2027 at 5,000

- Sell to Close a put on SPX in December 2027 at 4,300

- Buy to Close a put on SPX in December 2027 at 5,000

Buy – Sell – Sell – Buy.

Set Up Four Legs

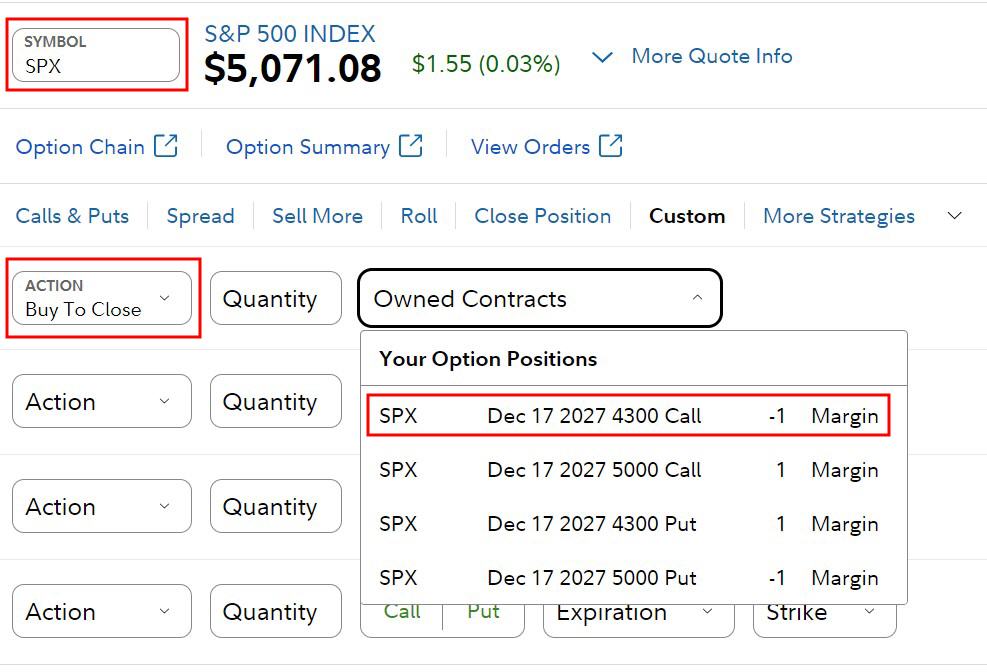

I held the box spreads through Fidelity. Fidelity shows the contracts you hold when you enter the ticker symbol and choose “Buy to Close” in the action dropdown.

Here are all four legs:

Calculate the Limit Price

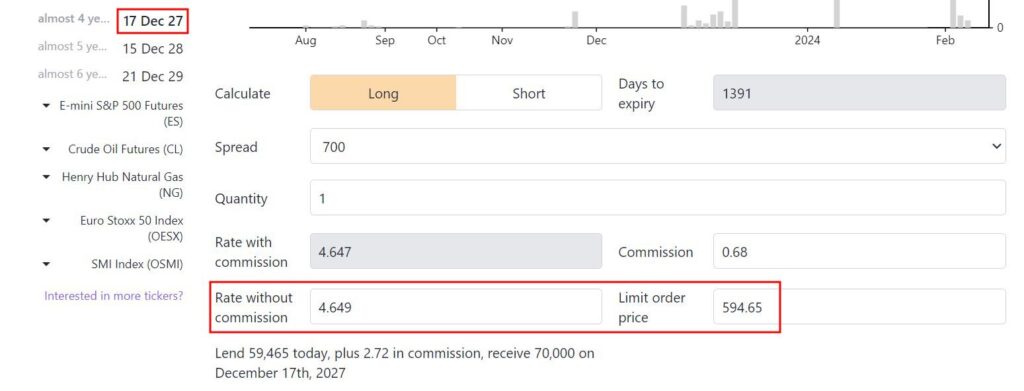

I checked the Treasury yields near the expiration date. It was around 4.4%.

Boxspreads.com showed that if I wanted a 4.65% yield (0.25% above Treasury), the target price for a 700-point spread in December 2027 was 594.65.

Use that price for the limit order in Fidelity.

Partial Close

If you don’t have enough money to close out the full box, you can also execute a partial close. You go up from the bottom of your spread or come down from the top of your spread to shrink the spread to a smaller size.

Suppose I want to shrink my 700-point spread to a 500-point spread, I would close at 4,300 and open at 4,500.

It’s still Buy – Sell – Sell – Buy except you’re going up from 4,300 to only 4,500, not from 4,300 to 5,000. After this trade executes, you’re left with a 4,500 – 5,000 box spread.

Alternatively, you can also come down from the top, to close at 5,000 and open at 4,800. Then you’re left with a 4,300 – 4,800 box spread.

- Buy to Open a call on SPX in December 2027 at 4,800

- Sell to Close a call on SPX in December 2027 at 5,000

- Sell to Open a put on SPX in December 2027 at 4,800

- Buy to Close a put on SPX in December 2027 at 5,000

Close Out a Long Box Spread

The same principle applies when you’re closing out a long box spread. These are the original trades for a long box spread:

- Buy to Open a call at X

- Sell to Open a call at X + spread

- Sell to Open a put at X

- Sell to Open a put at X + spread

Buy – Sell – Sell – Buy.

In opposite trades, “Buy to Open” becomes “Sell to Close” and “Sell to Open” becomes “Buy to Close.” These trades will close out a long box spread:

- Sell to Close a call at X

- Buy to Close a call at X + spread

- Buy to Close a put at X

- Sell to Close a put at X + spread

Sell – Buy – Buy – Sell.

Similarly, you can also partially close out a long box spread by using a smaller spread in your closeout trades.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

[ad_2]