[ad_1]

Americans are earning more income from their investments than ever before.

Here’s the data from the Wall Street Journal:

Americans in the first quarter earned about $3.7 trillion from interest and dividends at a seasonally adjusted annual rate, according to the Commerce Department, up roughly $770 billion from four years earlier.

That’s a whole lot of passive income.

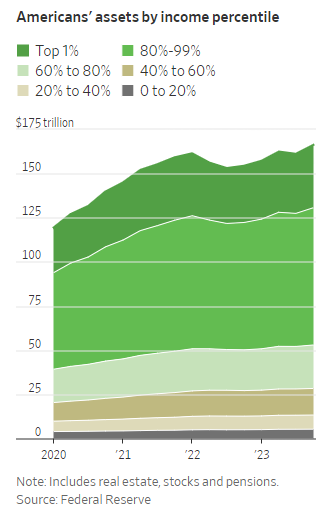

People who own financial assets are sitting pretty right now. Unfortunately, the majority of those assets reside in the hands of the wealthy:

The rich are getting richer. That’s a fact.

But that doesn’t mean people on the lower end of the wealth spectrum are being completely left behind.

In fact, the pandemic gains to lower income and net worth Americans are some of the highest on record.

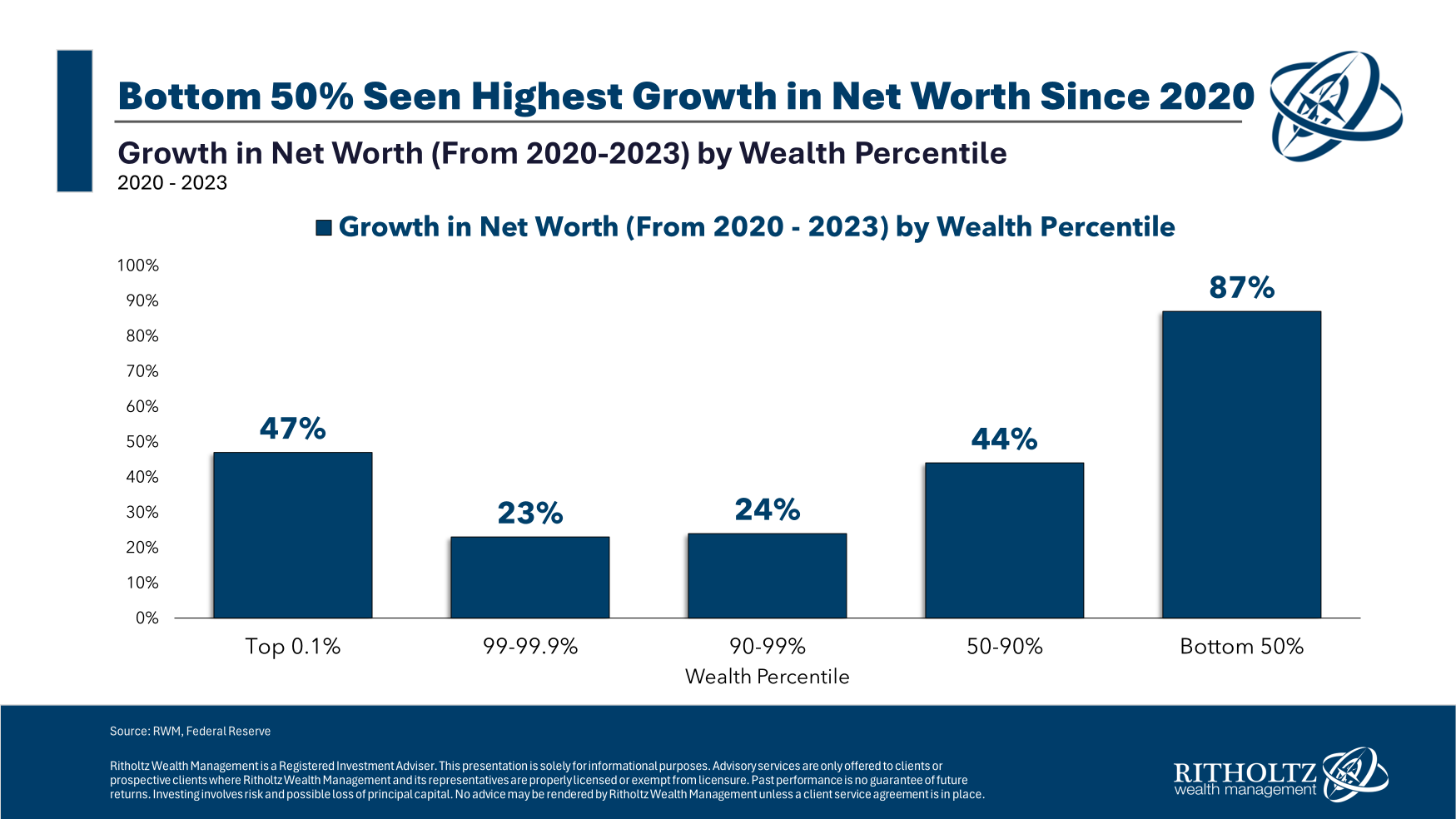

Here is the growth in net worth by wealth percentile from the start of 2020 through the end of 2023:

Over this four-year period, the bottom 50% saw the highest net worth growth of any group by far.

To be fair, that growth is coming off a much smaller base than the wealthier cohorts.

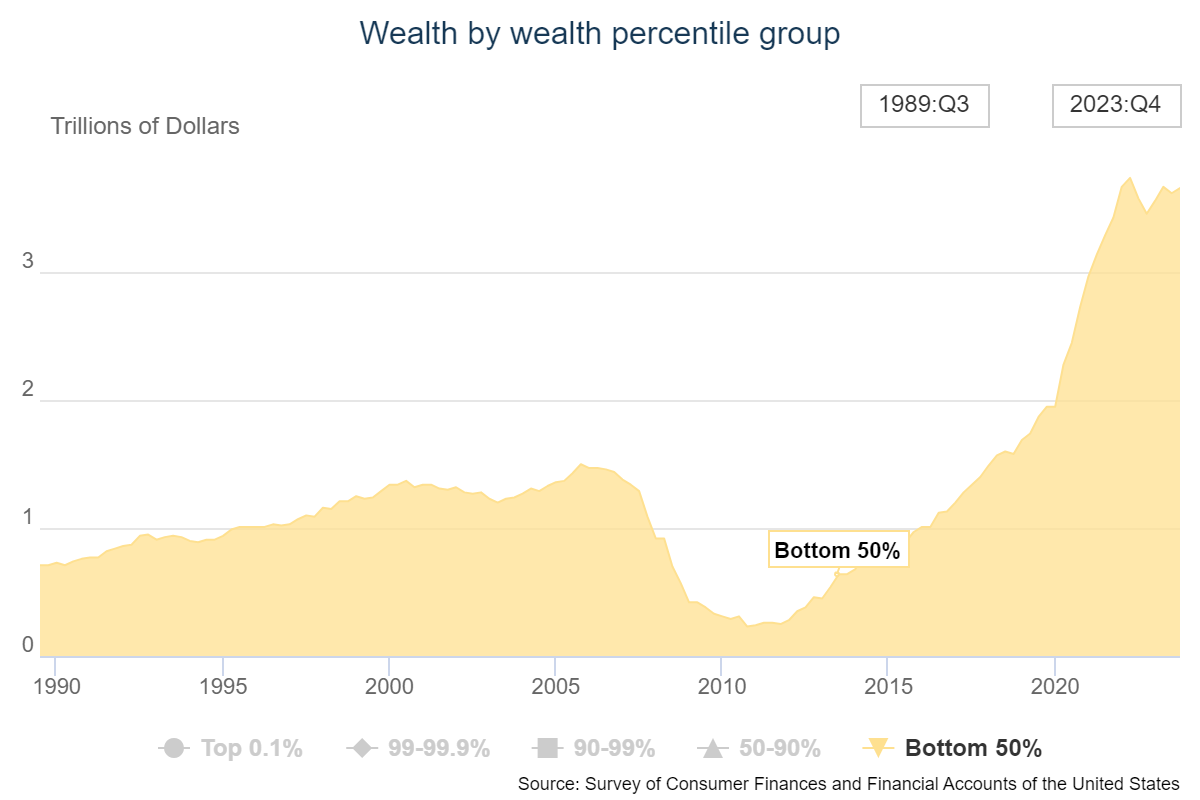

The net worth of the bottom 50% was decimated in the Great Financial Crisis but look at the sharp increase since 2020:

We’re not ending wealth inequality here, but the bottom 50% is in a much better financial position, even after accounting for inflation.

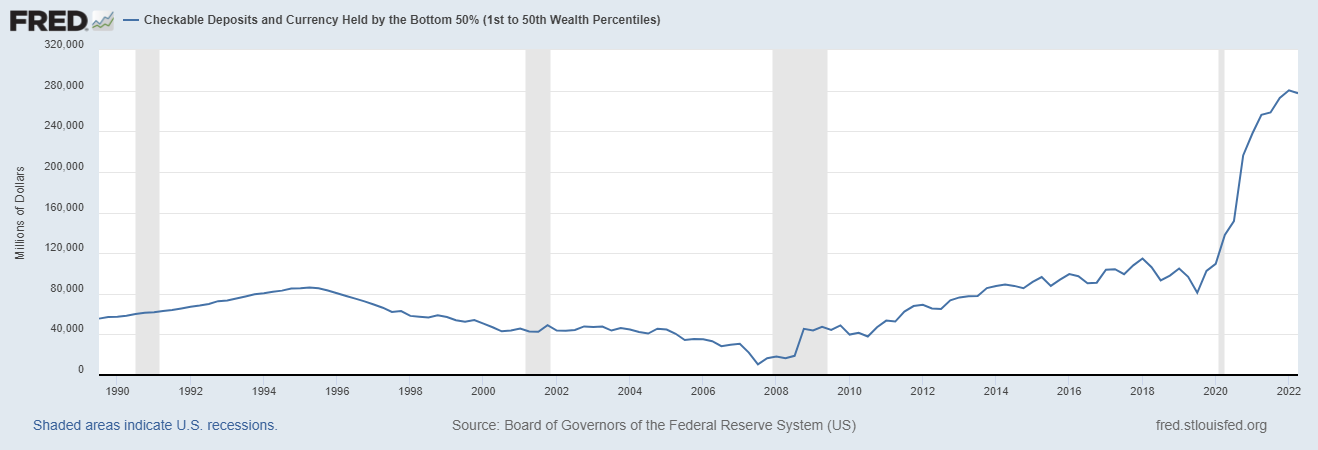

The bottom 50% also has a lot more cash in the bank:

Checkable deposits are up nearly 3x since the start of the pandemic.

There have been substantial income gains for the bottom half as well.

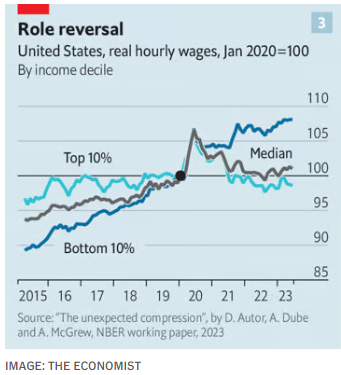

The Economist highlighted a new paper that sheds light on how incomes have changed during this period:

In a recent paper, Mr. Autor and colleagues demonstrate that tight American labour markets are leading to fast wage growth, as workers switch jobs for better pay, and that poorer employees are benefiting most of all. The researchers reckon that, since 2020, some two-fifths of the rise in wage inequality over the past four decades has been undone.

Here’s the chart which shows bigger gains for the bottom 10% than the top 10% in that time:

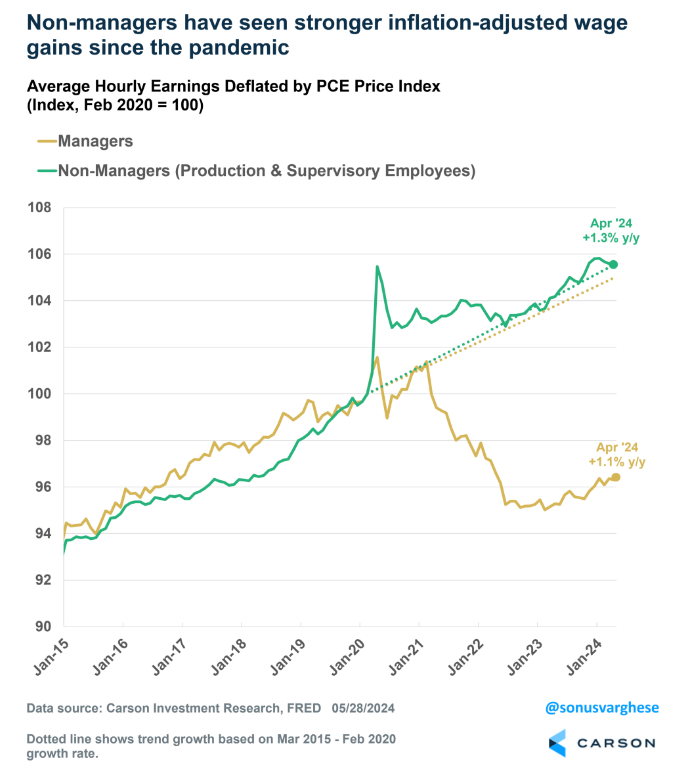

Sonu Varghese produced a chart that shows a similar divergence between manager and non-manager wages:

The employees have seen their wage growth handily outpace their boss’s pay growth since 2020.

All of this is good news!

This economic environment has been challenging but this outcome should be celebrated.

There are always two sides to every economic story. There are obviously still people in the bottom 50% who are being left behind, who haven’t experienced these wage increases and who have been harmed by the inflationary spike during the pandemic.

But taken as a whole, these numbers are encouraging. I hope we continue to see this stuff moving in the right direction.

My worry is we’re going to look back at the pandemic as a one-off historical economic anomaly, much like World War II was for the middle class.

Michael and I talked about the bottom 50% and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

America’s Piggy Banks Are Full

Now here’s what I’ve been reading lately:

- Setting the record straight on stocks for the long run (CFA Institute)

- We’re all surrounded by immense wealth (Raptitude)

- 10 financial rules of thumb you don’t have to follow (Morningstar)

- How many of our “facts” about society, health and the economy are fake? (Noahpinion)

- Making a living as a book author is as rare as being a billionaire (The Intrinsic Perspective)

- Can Glen Powell save movies? (Wild About Film)

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

[ad_2]