[ad_1]

Curious about the connection between Bond Yield Vs Returns? Let’s explore how changes in bond yield can affect the returns of debt mutual funds together!

The inverse relationship between bond yields and bond prices is a well-known fact. However, we often struggle to fully understand how this affects our debt funds. Therefore, I will illustrate this by presenting two examples of debt funds.

Let us first look into the 10-year Gsec bond yield data from 31st December 2013 to present day of present day.

Notice the volatility. It is all because of the inflation rate and interest rate cycle changes. Accordingly, the bond yield will change.

Bond Yield Vs Returns – How does it impact debt fund returns?

Now, let’s consider the impact of this yield on our debt mutual funds. To analyze this, I have selected two funds for comparison. The first one is the SBI Magnum Constant Maturity Fund, which is categorized as a fund that must invest a minimum of 80% in G-secs. This ensures that the Macaulay duration of the portfolio remains at 10 years, making it a long-term bond portfolio. On the other hand, the second fund I have chosen is the ICICI Pru Money Market Fund. This fund is mandated to invest in Money Market instruments with a maturity of up to 1 year, creating a short-term bond portfolio.

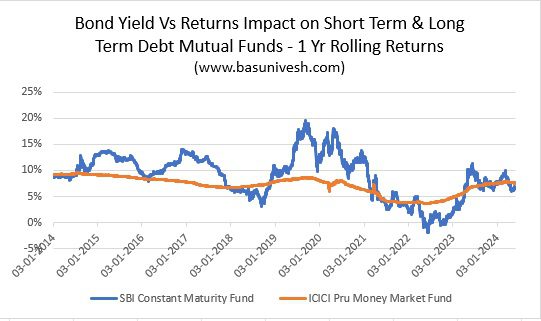

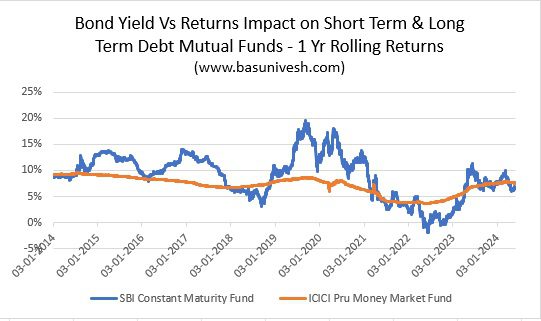

Let us compare both funds’ 1-year rolling returns and you can clearly visualize the volatility.

Observing the period from 2020 to the present, one can see a significant decrease in the returns of Gilt Funds, while the returns of Money Market Funds have been steadily increasing. This trend can be attributed to the high-interest rate environment that emerged post-Covid, which is still ongoing. Consequently, the prices of long-term bonds have experienced a sharp decline compared to short-term bonds.

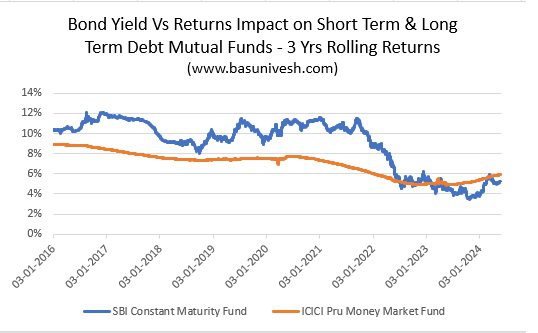

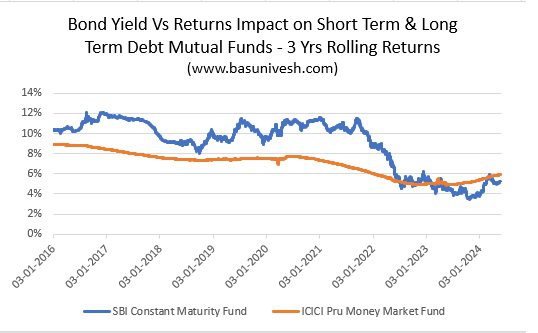

The volatility remains evident when analyzing the three-year rolling returns of each fund.

The Gilt Fund experienced a significant decrease in returns after 2020, whereas the Money Market Fund maintained a stable performance.

The impact of yield movement on our debt mutual fund returns is clearly highlighted by this comparison. Therefore, it would be unwise to blindly assume that debt funds are safe and that we can select any fund we desire, particularly based on past returns. Such an assumption may have negative consequences.

(Note – The reason for choosing these two funds lies in their significant AUM within their respective categories. Additionally, the selection of the time period starting from 2013 is specifically intended to emphasize direct funds exclusively.)

[ad_2]