[ad_1]

The Exit Poll & Actual Result Roller Coaster:

The markets pre-maturely celebrated the exit poll outcome. The actual poll result was a rude shock with the preferred party missing the majority mark. However, there is some solace with the NDA scoring 292 with its allies. Given that BJP alone has got more seats than the whole INDIA alliance put together. It is the BJP that will get invited to form the government and prove the majority. Chandra Babu Naidu endorsement of supporting NDA Alliance cheers the market with renewed hope.

Market Rationale preferring NDA continuity:

The market cheered the exit poll outcome and battered the market on a relatively adverse outcome. This clearly indicated the market’s preference of the BJP led government under the leadership of Shri. Narendra Modi. These three broad factors sums up the reason for the preference.

The market cheered the exit poll outcome and battered the market on a relatively adverse outcome. This clearly indicated the market’s preference of the BJP led government under the leadership of Shri. Narendra Modi. These three broad factors sums up the reason for the preference.

- Macro – Economic Fundamentals: The government has done very well to manage fiscal prudence and the macro-economic fundamentals.

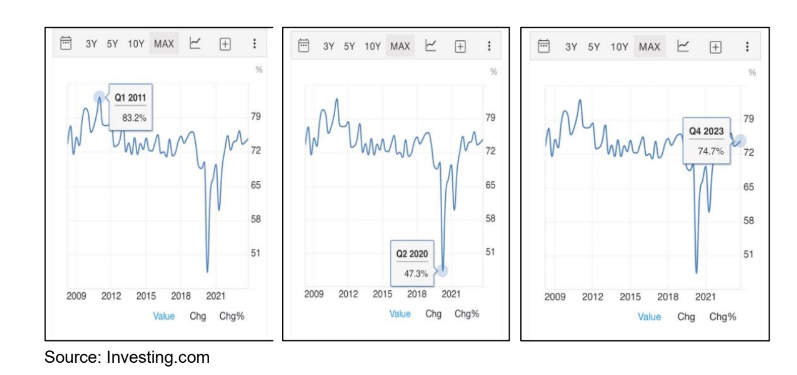

a. Current Account Deficit: India has done very well to sustain the CAD while maintain growth to approximate 1% levels despite high commodity prices.

b. Fiscal Deficit: the Indian government managed the pandemic very well with limited stimulus and prudent fiscal consolidation thereafter. The GST collections have been robust making the fiscal consolidation exercise more sustainable.

c. Inflation: RBI has maintained a hawk’s eye to manage Inflation. The government eased interest rates very prudently during pandemic and then a controlled tightening post the same. Further efficient forex management that navigated liquidity in the system well. Forex intervention to support rupee was managed well by RBI, without impacting inflation a lot. A strong forex reserves of USD 650 Billion. Most of the inflation in India were mainly driven by food side inflation. - Policy Continuity: The government implemented several policies promoting financial inclusion, Make in India, export growth, defence modernization, and Ayushman Bharat. They also implemented the IBC, PSU disinvestment, labour, PLI schemes and GST. This, coupled with assertive foreign policies, has propelled India onto a significantly better growth trajectory. The government continuity under the leadership of Shri. Narendra Modi Ji gives confidence of policy continuity that fosters economic growth & development.

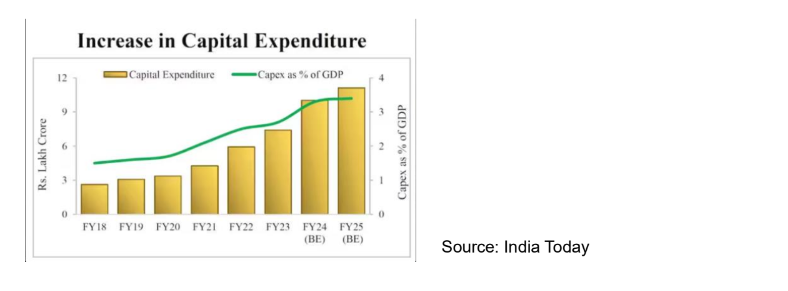

- Growth Capex Boost: The government allocated serious amount towards the capital expenditure plan and infrastructural growth.

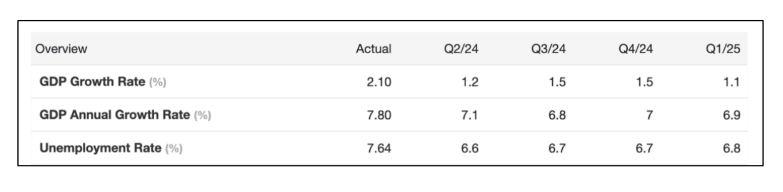

The India GDP preview:

The Investors are concerned with their investments beyond who forms the government. The GDP is an indicator of economic growth that reflects in the stock market performance. Throwing light purely from investment perspective,

Y = C + I + G + (X – M)

The GDP ( Y ) of the economy using the expenditure approach is measured by the above formula. It’s like the four wheels of the car. The three key players in the above equation are Households, Businesses and the Government.

C = Consumption of Indian households and non-profit organisations. I = Corporate expenditures and also home purchases by households. G = Government expenditures on goods & services.

(X-M) = Net Exports (i.e. – Export minus Import)

Consumption: The Consumption pattern in India has seen a surprising divergence – The urban and the rural divide.

We have seen increased consumption in Luxury apartments, fancy cars, high end consumption products, hotels, flights & restaurants in urban India. The urban population are opting for premium products including groceries, discretionary & household products. The urban consumption is at 1.5 to 2 times the national average.

While the rural economy that comprises of 40% of the Indian population are struggling to come out of the post pandemic crisis because of high inflation and poor monsoon. The rural consumers are either downgrading to cheaper products or shifting to local brands. Most listed FMCG have seen muted topline growth, given the pricing power they have they have increased their margin to sustain their earnings growth.

If India has to leverage the population potential, boosting consumption will lead to economic growth. The expected normal monsoon can uplift the rural consumption. Increasing employment and some bit of populist measures in moderation may not impact fiscal consolidation but can alco aid in boosting rural consumption. We will have to wait for the budget next month.

Private Sector Spend: The capacity utilisation is an indicator that signal private sector capital expenditure plans. The current capacity utilisation is about 75%. The corporate houses starts to add capacities if the utilisation level reaches closer to 85% (+/- 2%). The private sector capex cycle will take a while before it picks up.

The overall bank credit growth rate is expected to decline from 16% to 14%. The corporate credit growth is linked to capacity utilisation & capacity expansion. The retail credit is on the rise though. RBI is worried about the retail lending quality tightening the grip on all the unsecured lenders.

Having said that we will see increased capital allocation to some of the new emerging sectors such as semi-conductors, electric vehicles, solar energy, etc.

Government Spending: The current BJP government has be very frugal with populist measures and have handled capital efficiently allocation it towards infrastructure and capital growth. The increased government spending is assisting the GDP growth momentum. The next budget will showcase how the government allocates capital in the new coalition regime.

India’s long term growth story remains intact but we may face some headwinds in the short term.

Market Valuation – No longer cheap:

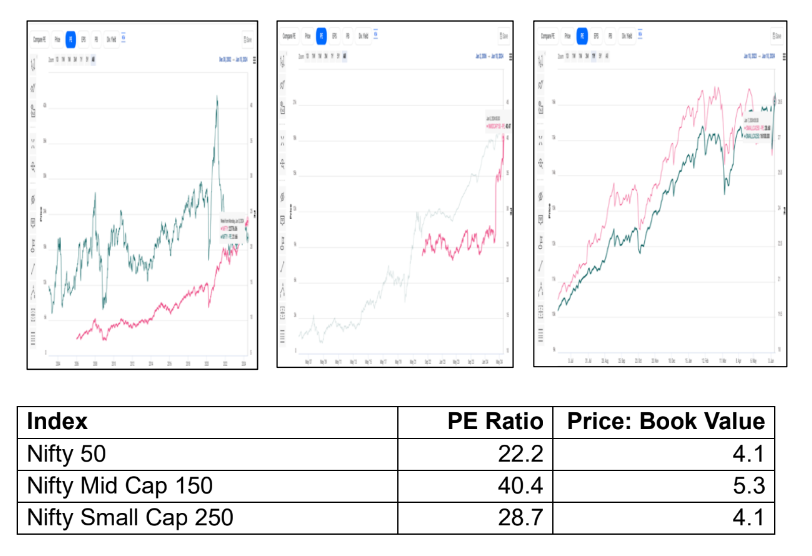

The market PE for the different segment of the equity market are:

The market-cap to GDP ratio is at 132% while the long term average is 90%+.

At this point of time the large cap segment of the market is available at a relatively better valuation. The Mid Cap and Small Cap of the market are expensive.

Navigating the portfolio:

Re-balance your equity exposure: The average EPS growth of Nifty100 companies is estimated to be 16%. The large cap companies are estimated to deliver an average EPS growth of 16%. While the Mid Cap and Small Cap may grow a little more.

Given the above we had booked profit from the mid & small cap in the past. Having said that we firmly believe in asset allocation and not timing the market. Hence, we triggered systematic transfer plan after booking profit over a period of time. It is time we re-balance our equity exposure and bring it a bit down.

Be cautious but don’t be afraid: Corrections in the equity market are part & parcel of equity investing. Any short – term corrections offers opportunity for long-term investors to buy at the lower levels. In our belief that there is abundant liquidity to protect too large a correction in the Indian equity market. The systematic investment plan book size of 20,000 crores+ per month and more than 250,000 Crores in dynamic asset allocation hybrid funds offers buying support on account of any knee-jerk corrections. FIIs inflow could add to the rally.

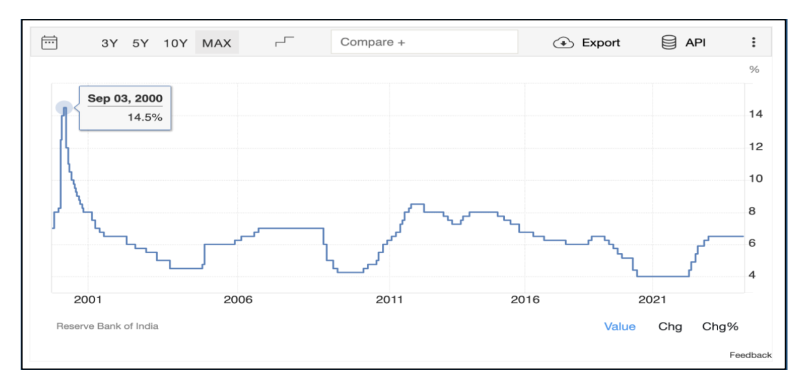

Lock your fixed income rate: In the year 2000 RBI Tax Free Bonds were available at 12% per annum while many good corporates where borrowing at an interest rate of 16% per annum.

Previously we have already seen interest rates going gown to 4%. Now with much better macro-economic fundamentals it will not be any surprise that interest rates head even lower than 4%. The era of high interest rates could be over. In such a situation one must lock in the fixed income returns by investing in very long term bonds or any other alternative opportunities available.

Gold: India’s improved macro – economic fundamentals will ensure that the Indian Rupee depreciate at a slower rate than the average of 4%. We maintain a positive stance on gold given the increased geo-political tensions and weakening dollar fundamentals.

Please speak with your wealth manager for a detailed interaction.

[ad_2]