[ad_1]

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth and you’re using FreeTaxUSA, please follow How to Report Backdoor Roth In FreeTaxUSA (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15, 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in FreeTaxUSA for the first year. Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year shows you how to do the conversion part for the second year.

If you recharacterized your 2023 Roth IRA contribution to Traditional in 2023 and converted to Roth again in 2023, please use another follow-up post.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Contributed for the Previous Year

Here’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below for both you and your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution in the following year, please jump over to the next example.

Contributed to Traditional IRA

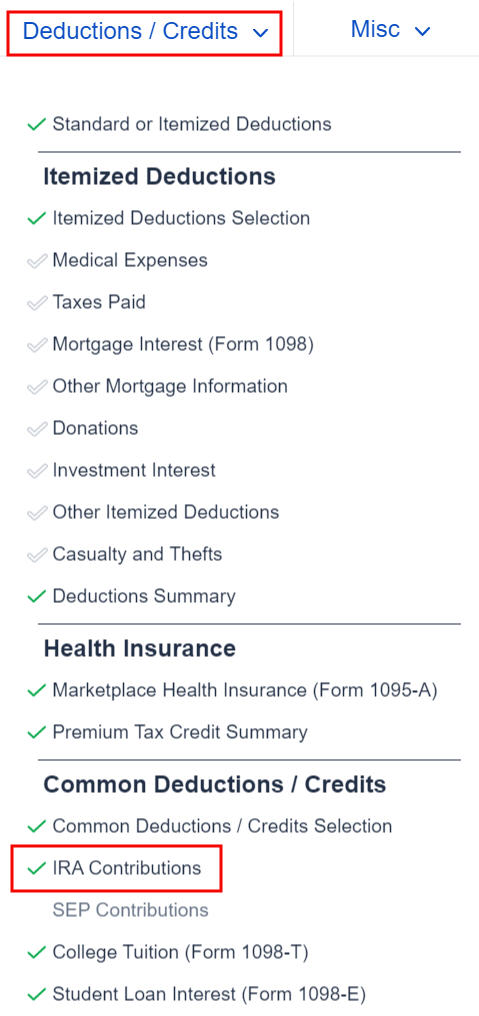

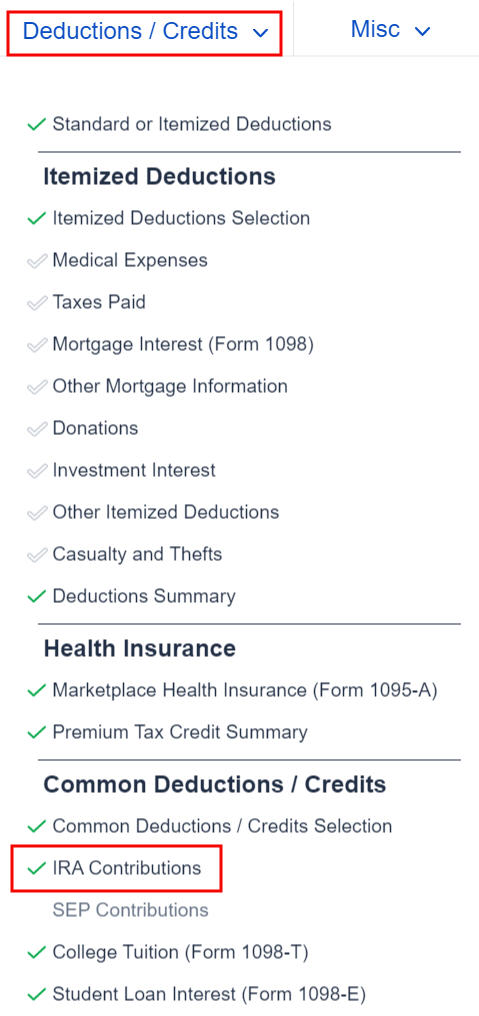

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

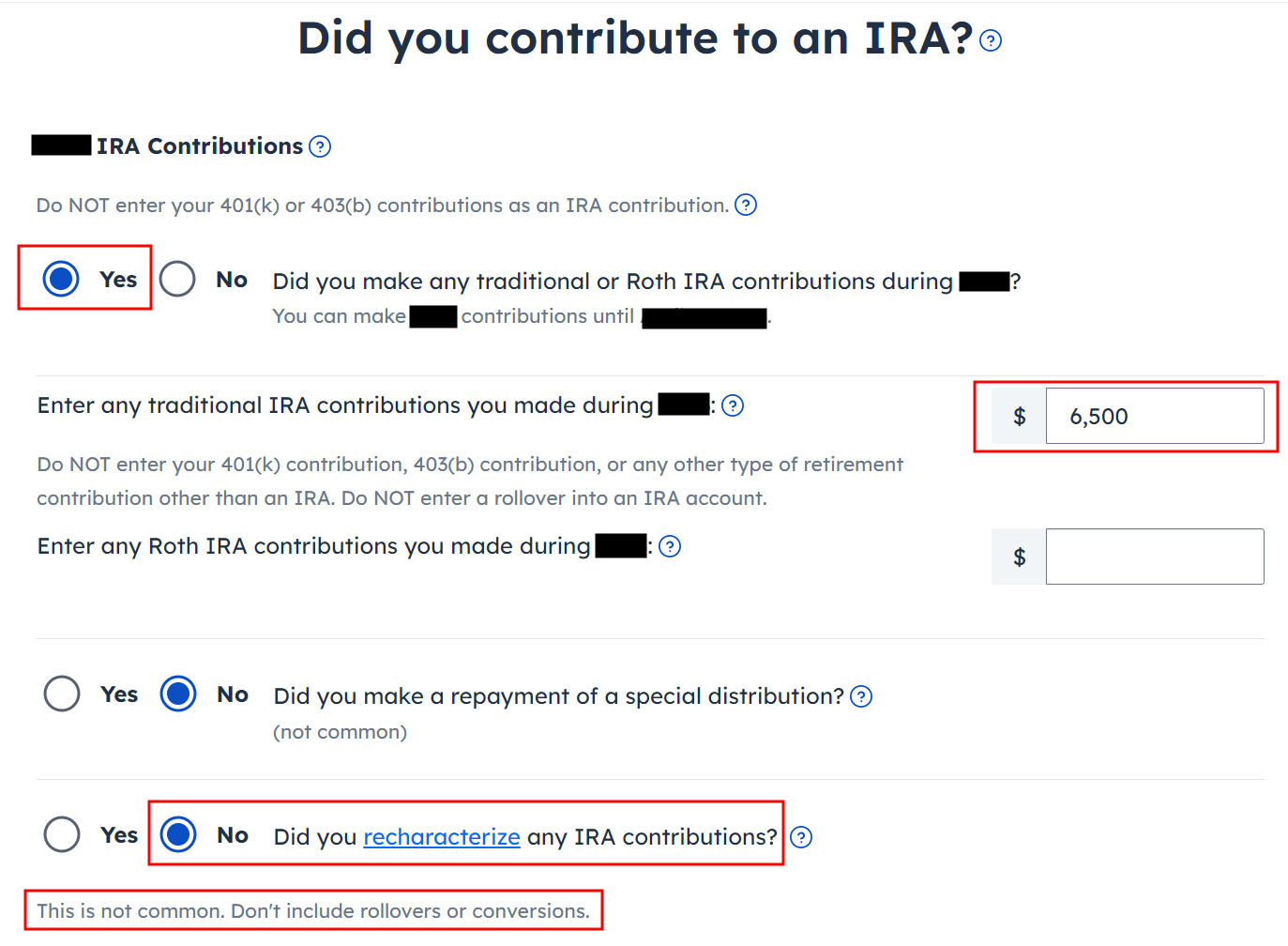

Answer Yes to the first question and enter your contribution in the first box even though the question says “made during 2023″ and you actually contributed in the following year. Leave the answer to “Did you recharacterize” at No.

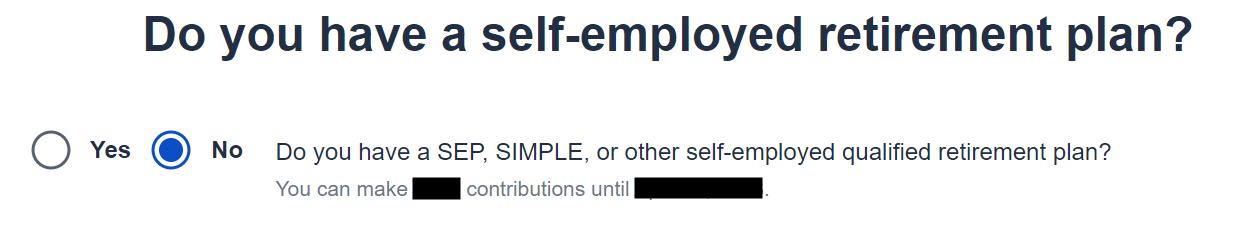

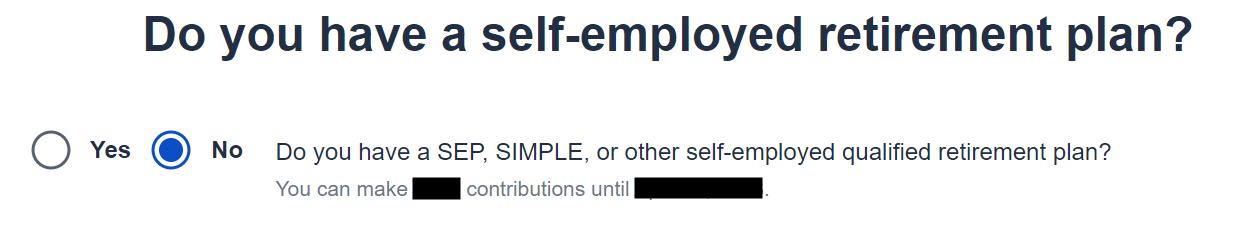

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

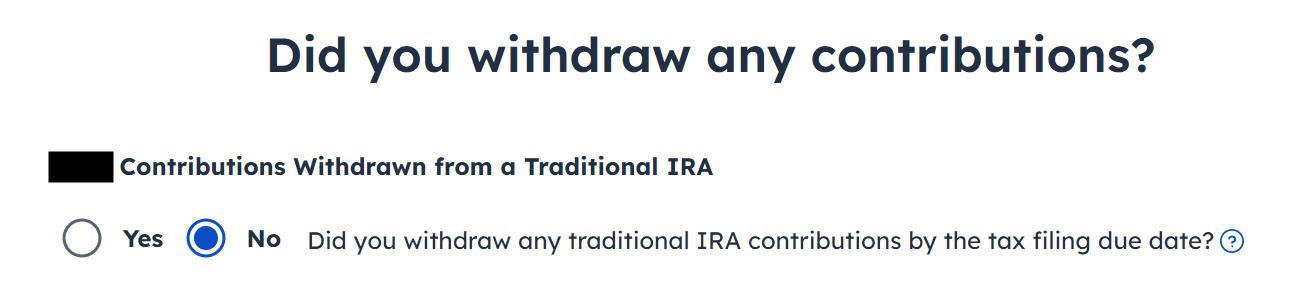

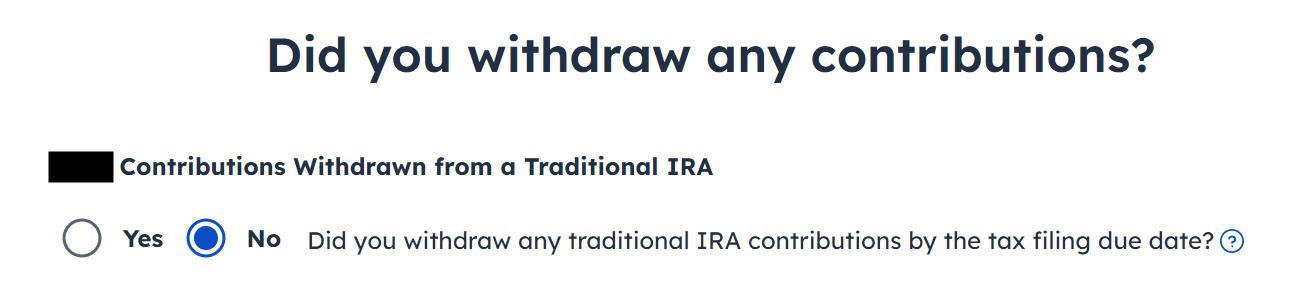

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

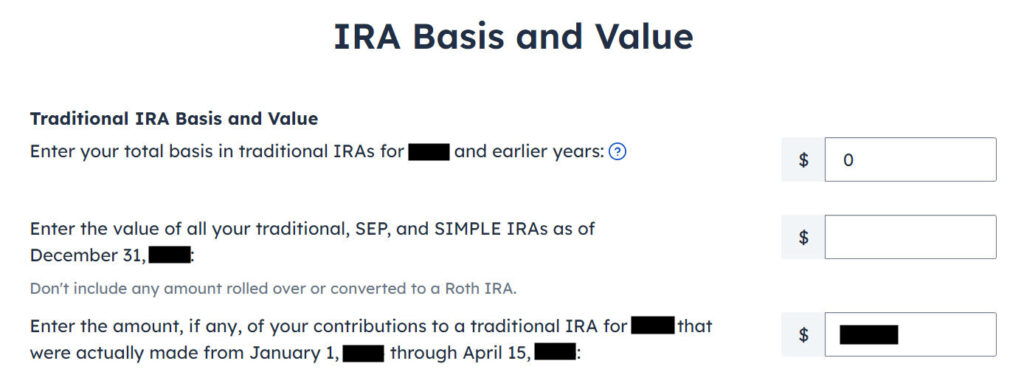

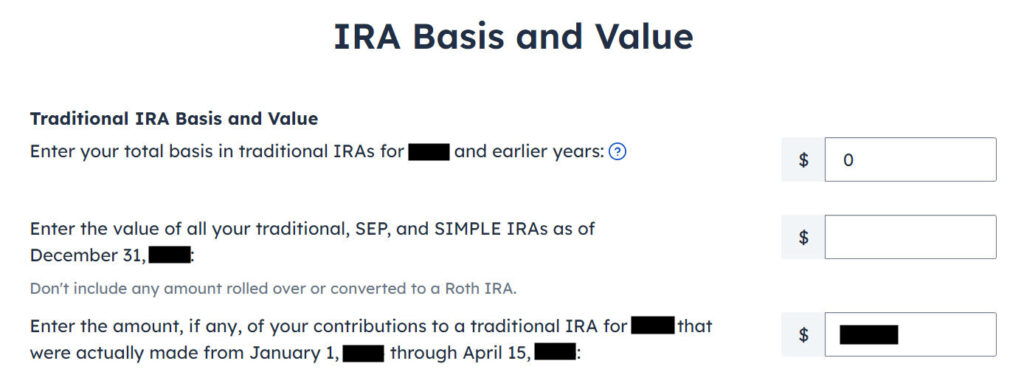

The first box is normally zero if this is the first time you contributed to a Traditional IRA. If you made nondeductible contributions to a Traditional IRA in previous years, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2023.

Enter your contribution in the third box because you did it between January 1 and April 15, 2024.

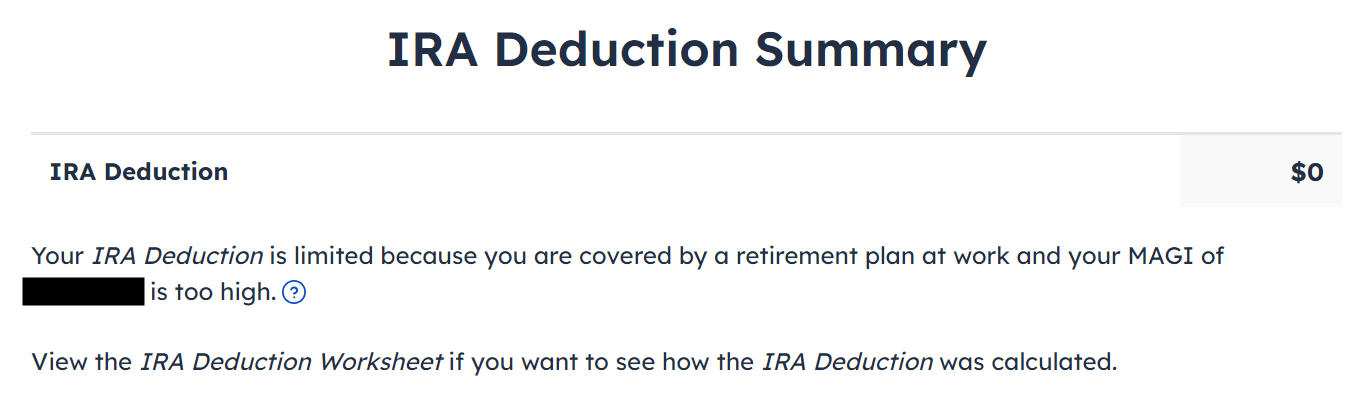

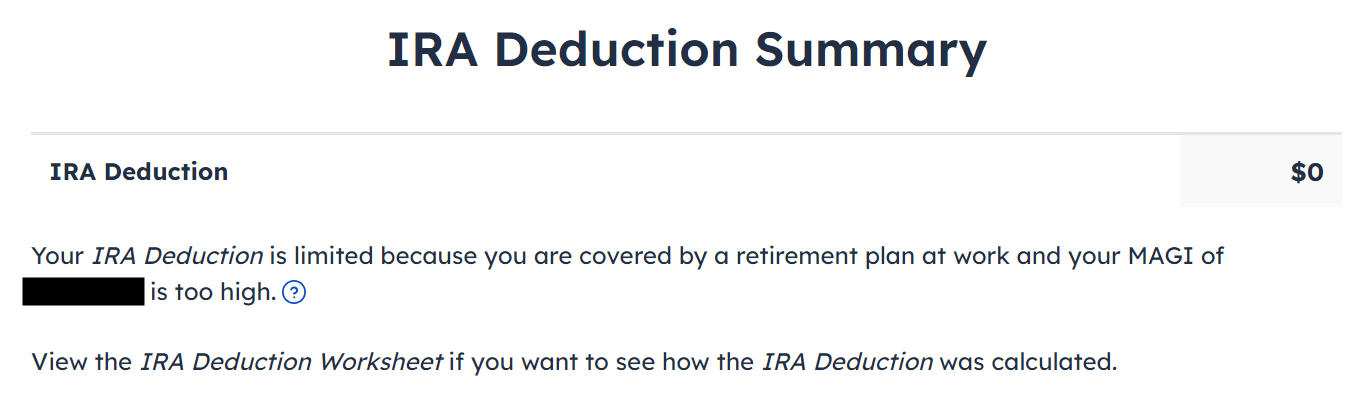

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth. If the number isn’t zero here, it means the software thinks you qualify for a deduction with your income. You don’t have a choice to decline the deduction.

Form 8606

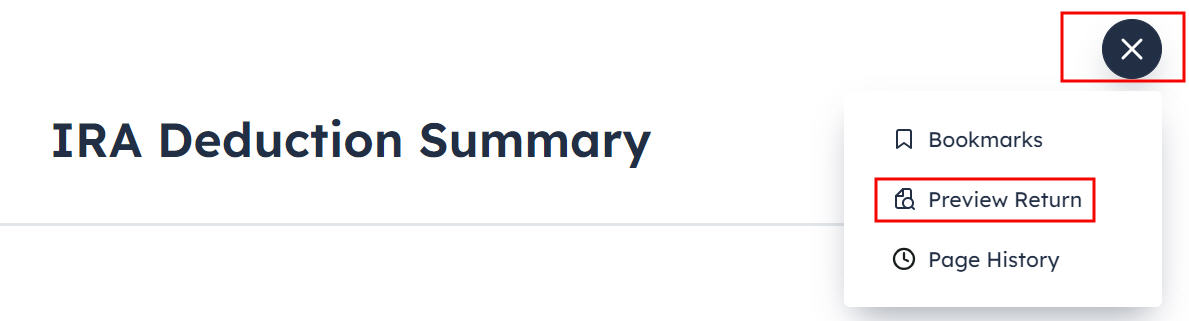

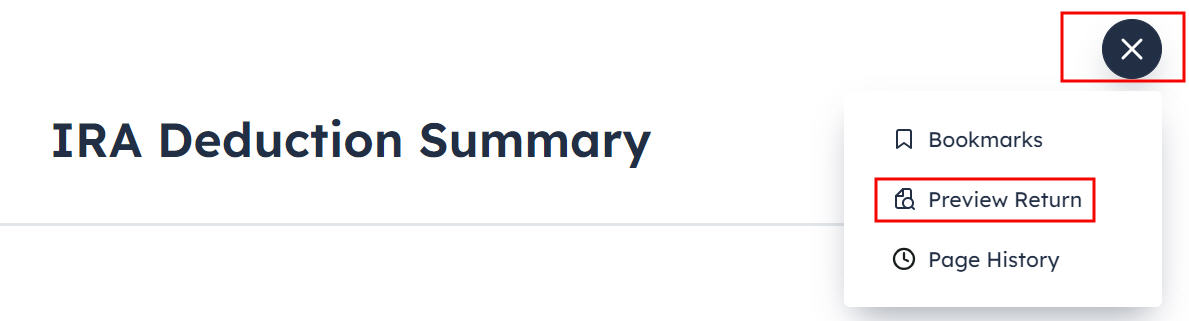

Let’s look at the Form 8606 to confirm that it did everything correctly. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the Cycle

While you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Roth Contribution

Now let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to follow Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

Contributed to Roth IRA

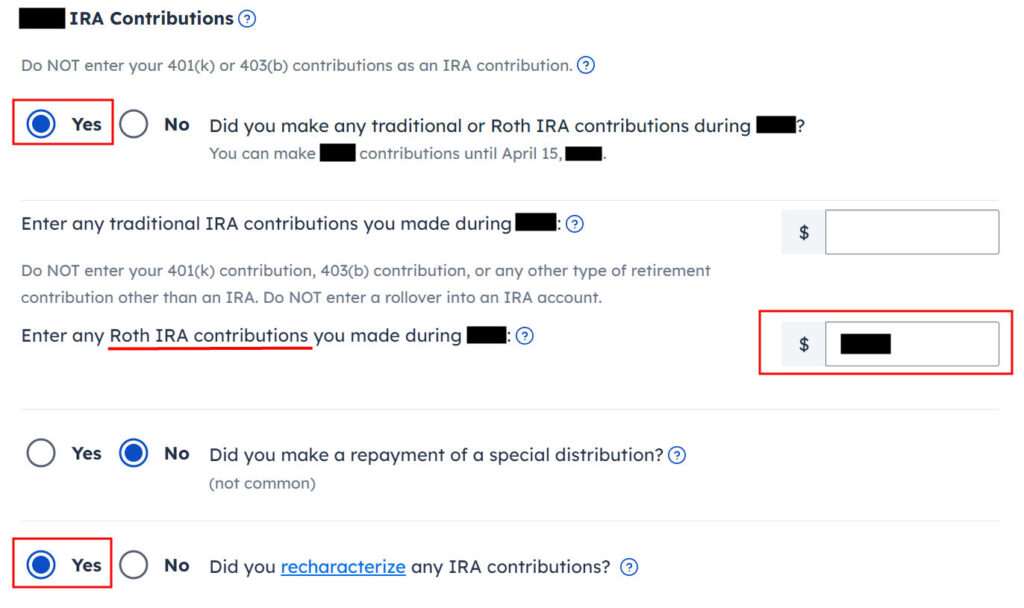

Find the IRA Contributions section under the “Deductions / Credits” menu.

Answer “Yes” to the first question and enter your contribution in the second box (because you originally contributed to a Roth IRA). It doesn’t matter when the question says “made during 2023″ and you actually contributed in the following year. Answer “Yes” to “Did you recharacterize.”

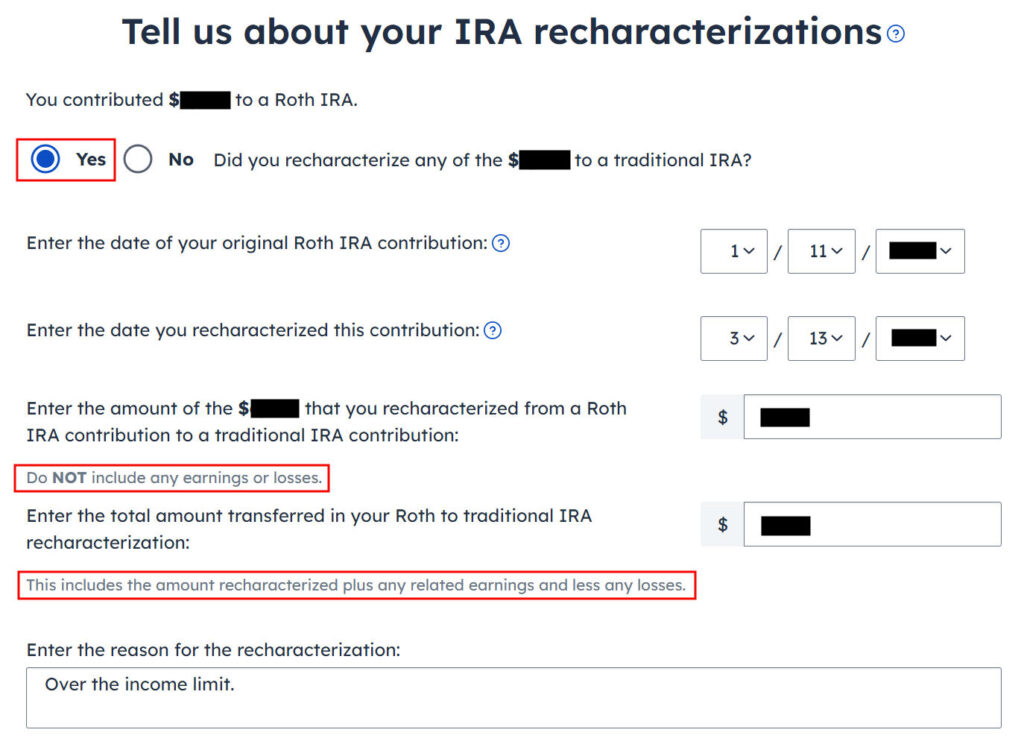

Recharacterized to Traditional

Select “Yes” to confirm you recharacterized a contribution. It opens up additional inputs for a statement required by the IRS. If you recharacterized 100% of your original contribution, enter it in the first box. It’s $6,500 in our example. We enter $6,600 from our example in the second box.

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

All three boxes should normally be blank or zero.

The first box is normally zero when you didn’t make any nondeductible contributions to a Traditional IRA in previous years. If you did, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2023.

The third box is also blank or zero because you made the original contribution in 2023. Recharacterizing makes it as if you contributed to a Traditional IRA to begin with.

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth. If the number isn’t zero here, it means the software thinks you qualify for a deduction with your income. You don’t have a choice to decline the deduction.

Form 8606

Let’s look at the Form 8606 to confirm that it did everything correctly. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Switch to Clean Backdoor Roth

While you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-R

You get a 1099-R only if you converted to Roth in 2023. Because you only converted in 2024, you won’t get a 1099-R until 2025. This is normal. You do the conversion part next year by using Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

Contribution Is Deductible

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. FreeTaxUSA will give you the deduction if it sees that you qualify. It doesn’t give you the choice of making it non-deductible. You see this deduction on Schedule 1, Line 20.

You don’t get a Form 8606 when your contribution is fully deductible. The numbers on Lines 1, 3, and 14 of your Form 8606 are less than your full contribution when your contribution is partially deductible.

Taking this deduction also makes your Roth IRA conversion taxable next year. You’ll pay less tax this year and more tax next year. In a way, it’s better because you get to use the money for one year.

If you actually have a retirement plan at work, the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries in FreeTaxUSA to make sure they match the W-2.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

[ad_2]