[ad_1]

The previous post Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part in FreeTaxUSA.

We cover two example scenarios in this post. Here’s the first:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into FreeTaxUSA.

Here’s the second example scenario:

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into FreeTaxUSA.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please use a different follow-up post.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below for both yourself and your spouse.

1099-R for Recharacterization

This section only applies to the second example scenario. If you contributed directly to a Traditional IRA for the previous year and didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

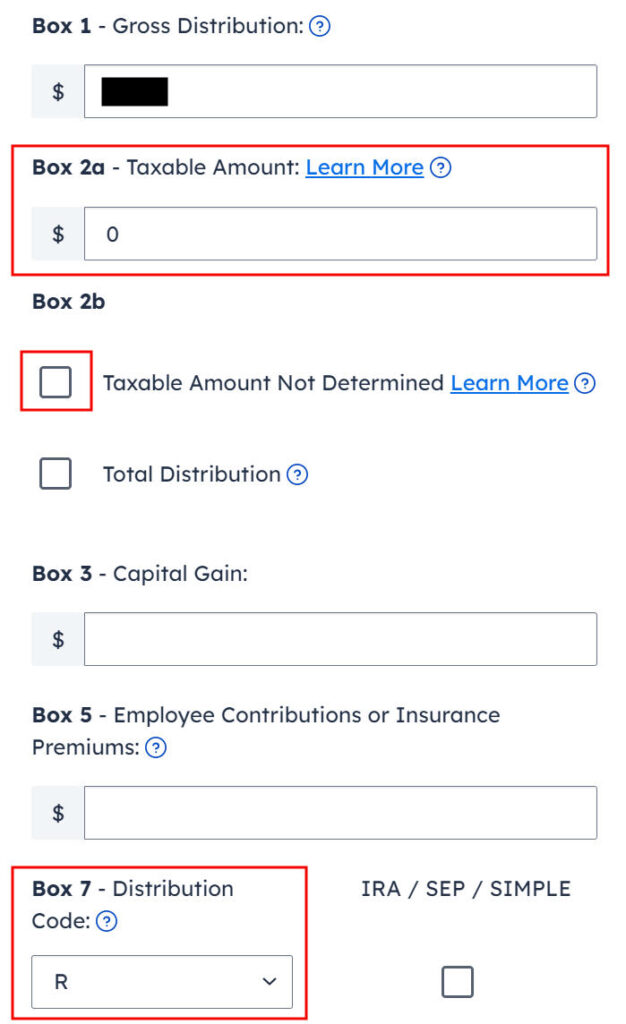

We handle the 1099-R form for recharacterization first. This 1099-R form has a code “R” in Box 7.

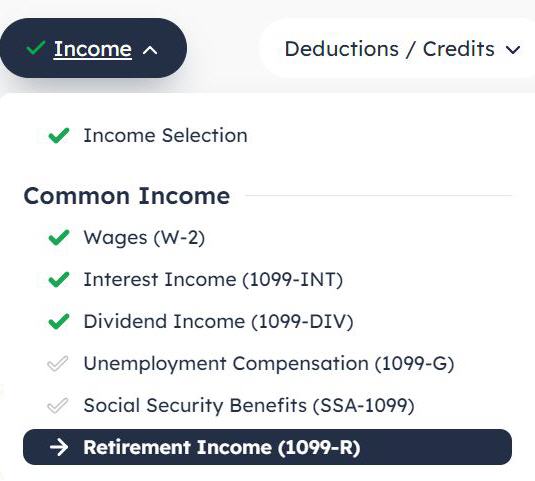

Find “Retirement Income (1099-R)” under the Income menu.

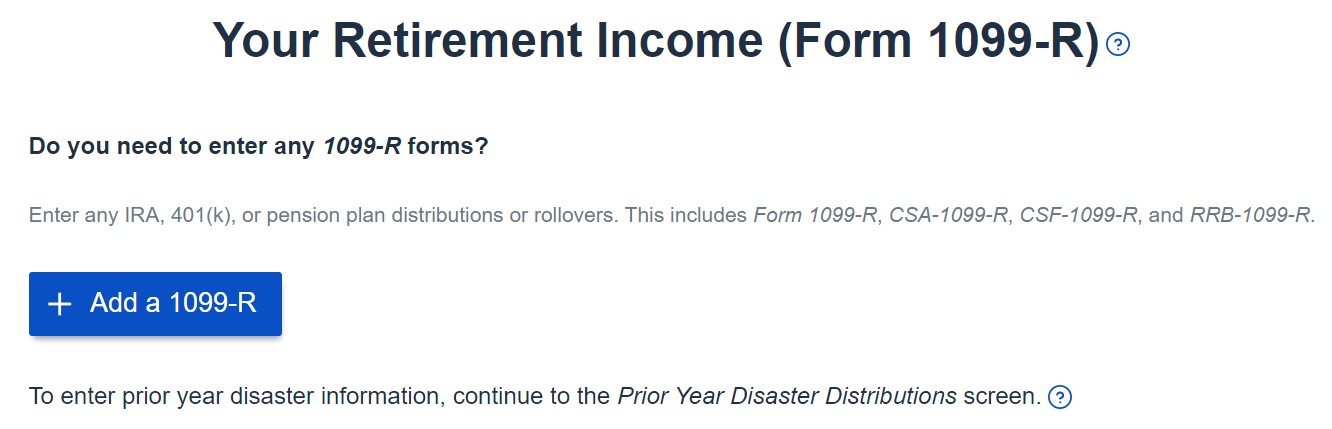

Click on the “Add a 1099-R” button.

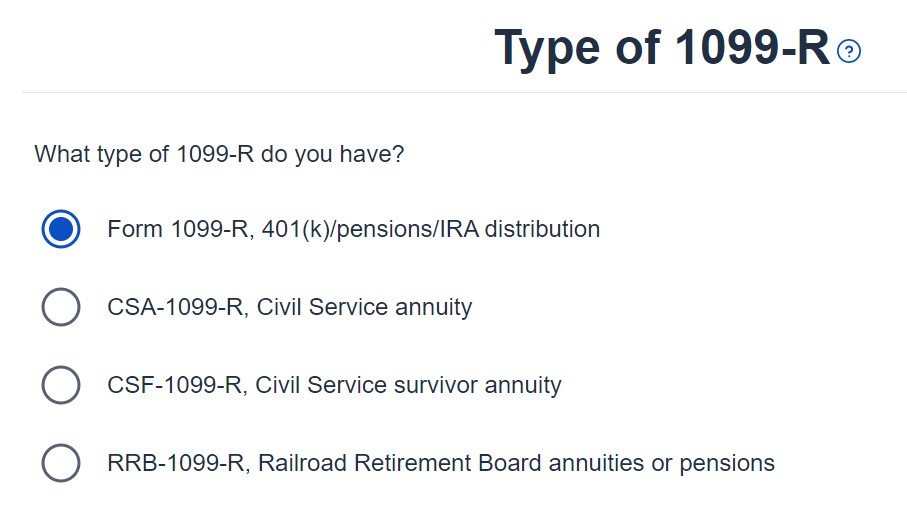

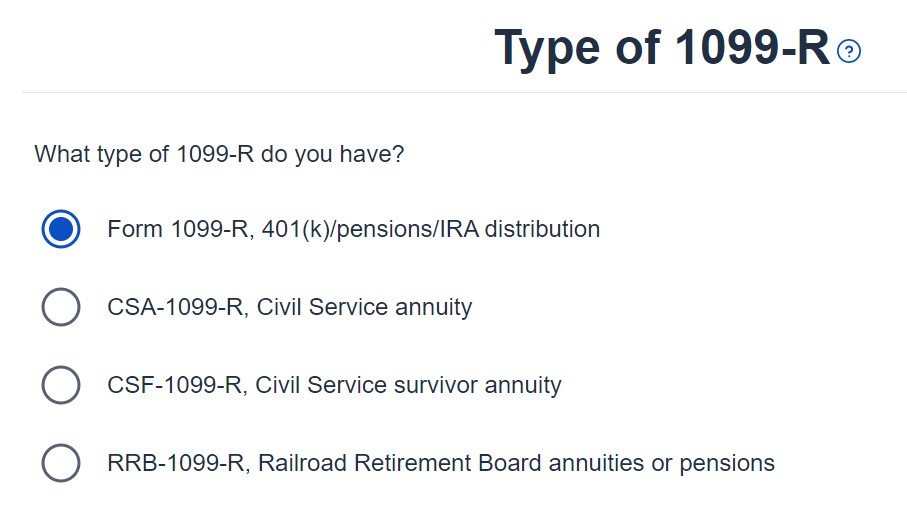

It’s just a regular 1099-R.

Enter the 1099-R for the recharacterization exactly as you have it. Box 1 shows the amount that was transferred from the Roth IRA to the Traditional IRA when you recharacterized your 2022 contribution. Box 2a shows that the recharacterization isn’t taxable. Box 2b “taxable amount not determined” isn’t checked. The code in Box 7 is “R.” The “IRA / SEP / SIMPLE” box isn’t checked.

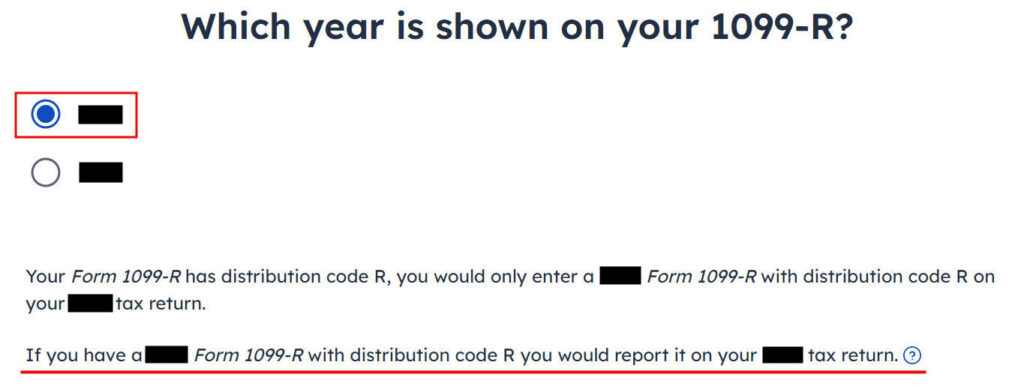

Your 1099-R shows 2023 but FreeTaxUSA says you should’ve reported it on your 2022 tax return. The problem is you didn’t have it back then. You couldn’t have reported something you didn’t have. Select the correct year and continue anyway.

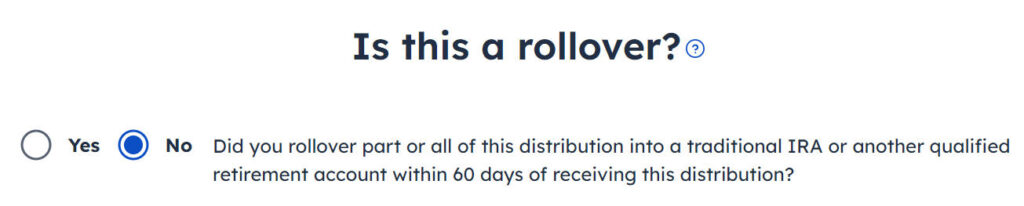

The recharacterization wasn’t a rollover.

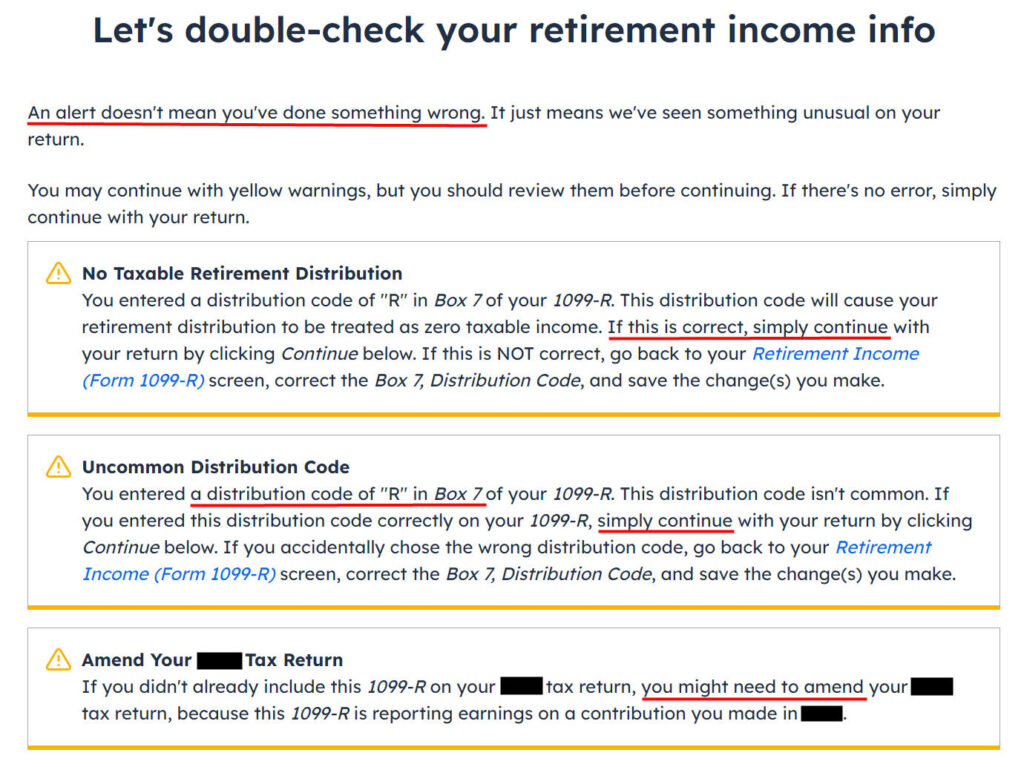

FreeTaxUSA shows some alerts. The zero taxable income on the 1099-R is correct. Code “R” in Box 7 is also correct. Although you didn’t include this 1099-R last year because you didn’t have it at that time, you don’t need to amend last year’s tax return if you reported the recharacterization in a different way when you followed Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. You may need to amend last year’s return only if you didn’t report the recharacterization last year at all.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

1099-R for Conversion

The 1099-R for conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

It’s also a regular 1099-R.

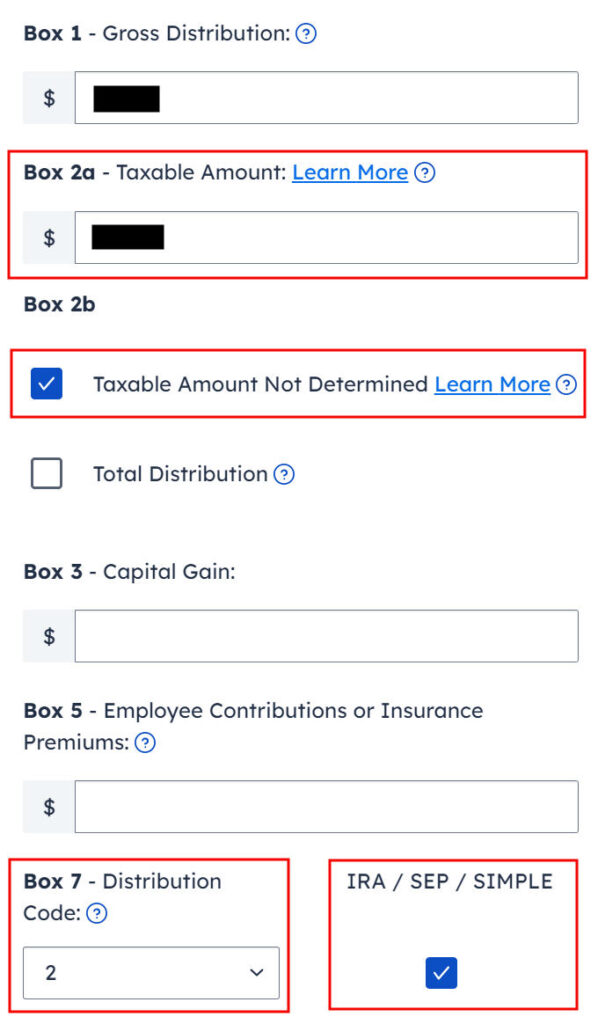

Box 1 shows the amount converted to Roth. If you contributed to a Traditional IRA for 2023 in 2023 and converted in 2023 (a “clean” backdoor Roth) on top of converting the 2022 contribution in 2023, the amount on the 1099-R includes two years’ worth of contributions. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter the 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

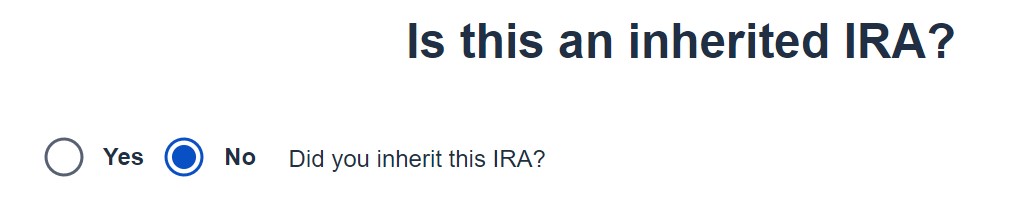

It’s not an inherited IRA.

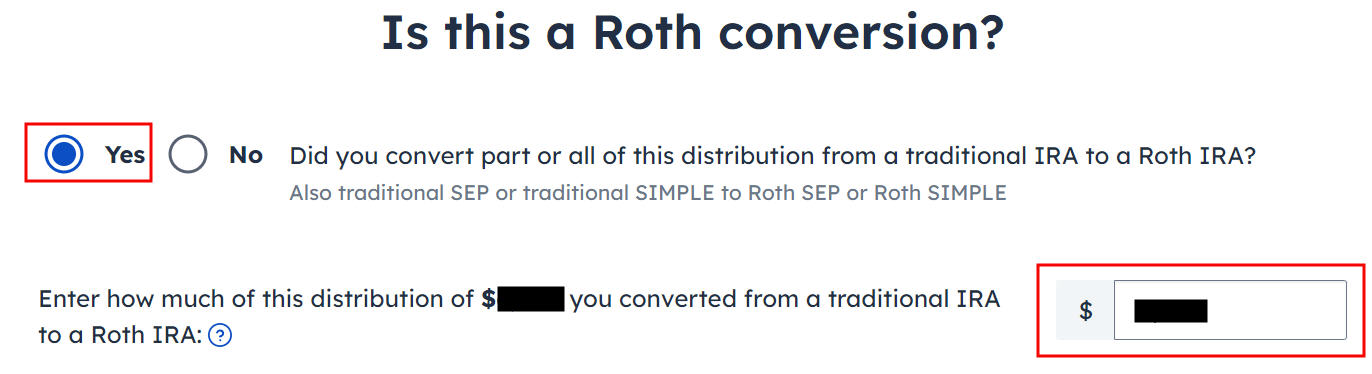

It’s a Roth conversion. 100% of the amount on the 1099-R was converted from a Traditional IRA to a Roth IRA.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “No, Continue” when you have entered all the 1099-R forms.

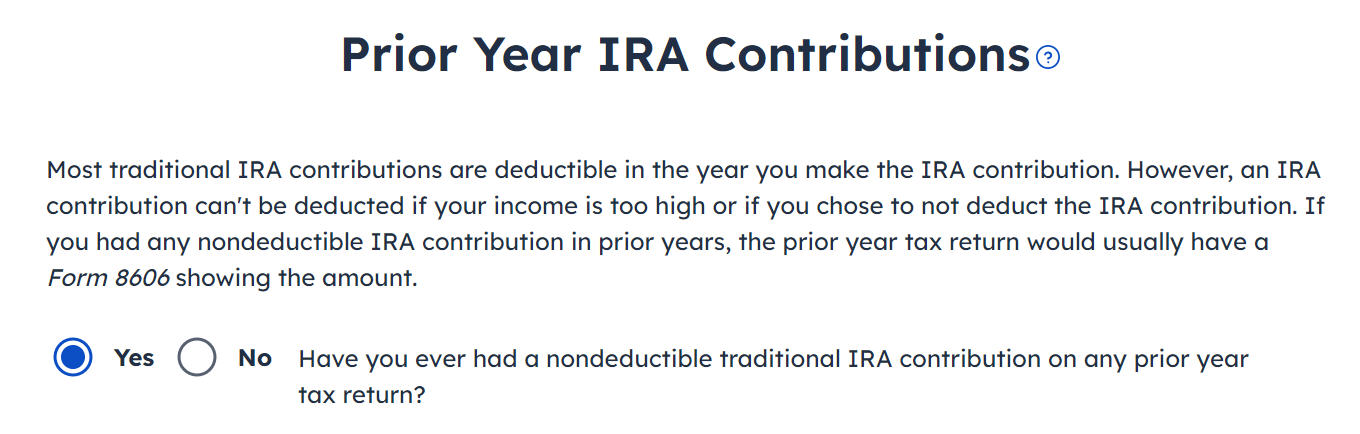

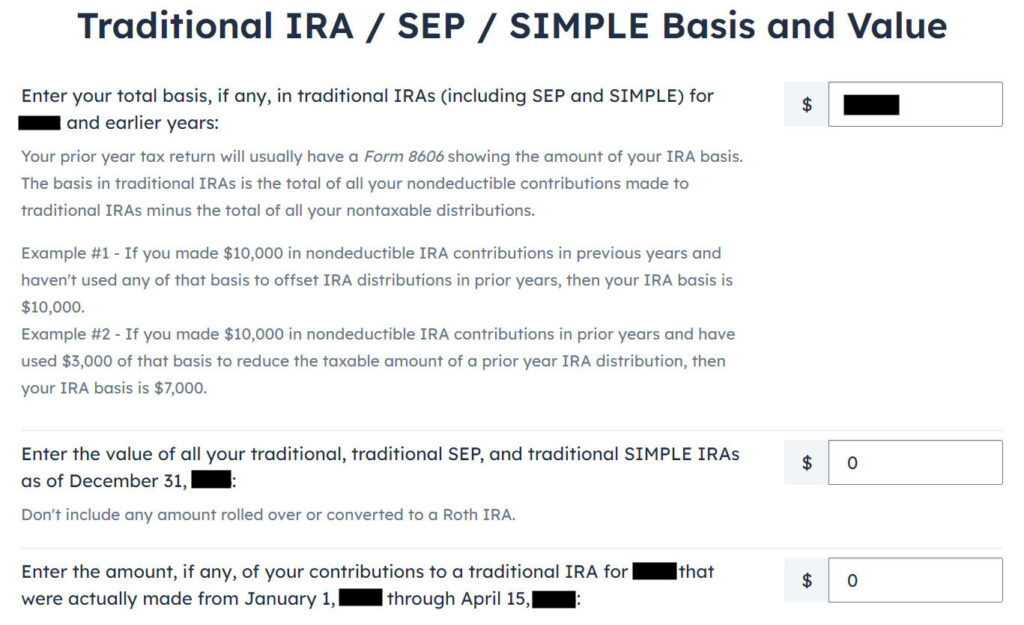

Answer “Yes” here because you had a Traditional IRA contribution from last year.

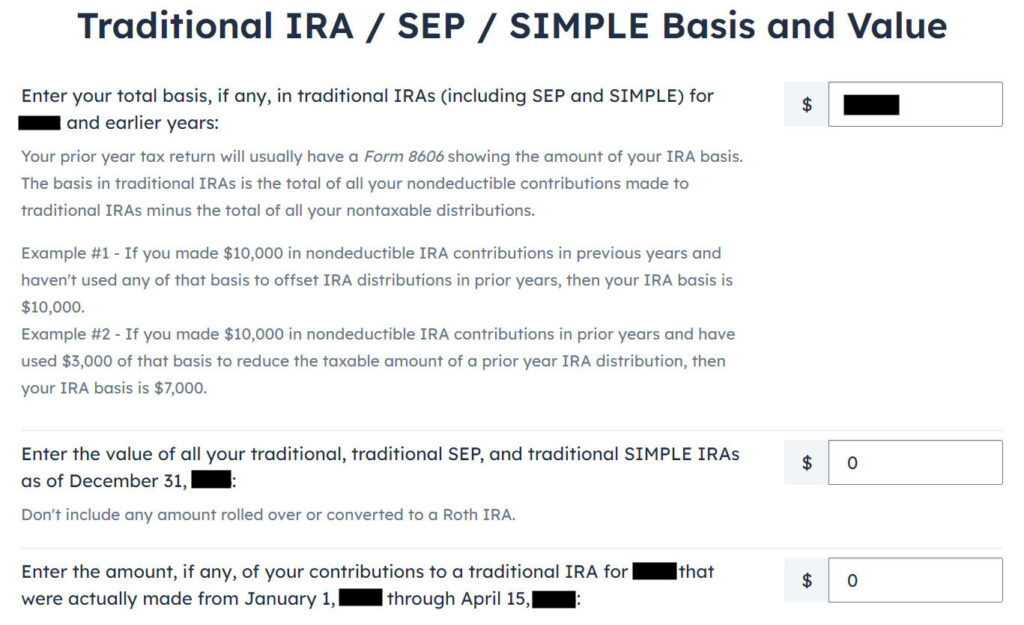

Get the value for the first box from last year’s Form 8606 Line 14 (assuming that you did last year correctly). If you didn’t have a Form 8606 last year because you didn’t do it correctly, your basis is the amount of your 2022 Traditional IRA contribution minus any deduction you took on last year’s Schedule 1 Line 20. The total basis is $6,000 in our example.

The second box should be zero when you emptied all your Traditional IRAs after converting them to Roth and you don’t have any SEP or SIMPLE IRAs. If you had a few dollars of earnings posted in the Traditional IRA after you converted and you left them in the account, get the value from your year-end statement and put it in the second box. The software will apply the pro-rata rule.

The third box should also be zero when you made your 2023 contribution in 2023.

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income.

Clean Backdoor Roth On Top

If you did a “clean” backdoor Roth on top of converting the 2022 contribution in 2023 (contributed to a Traditional IRA for 2023 in 2023 and converted in 2023), the conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

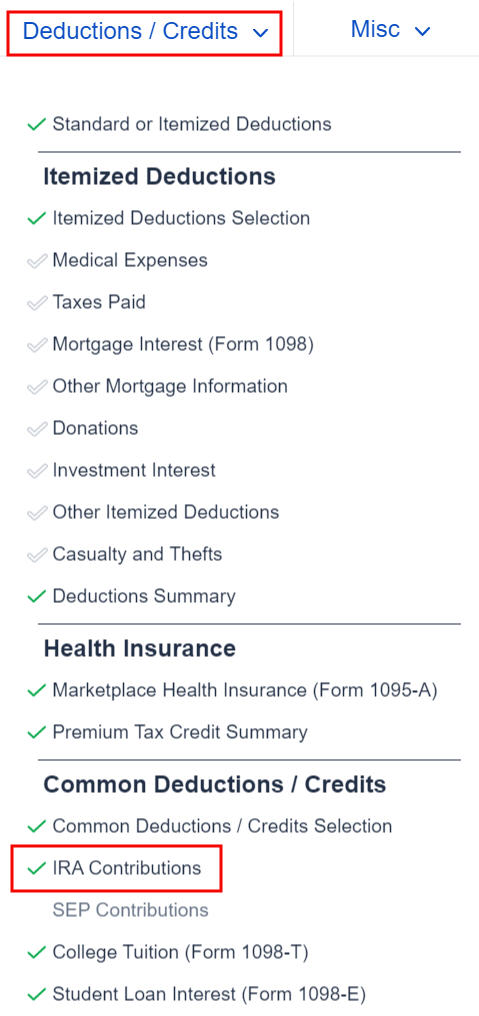

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

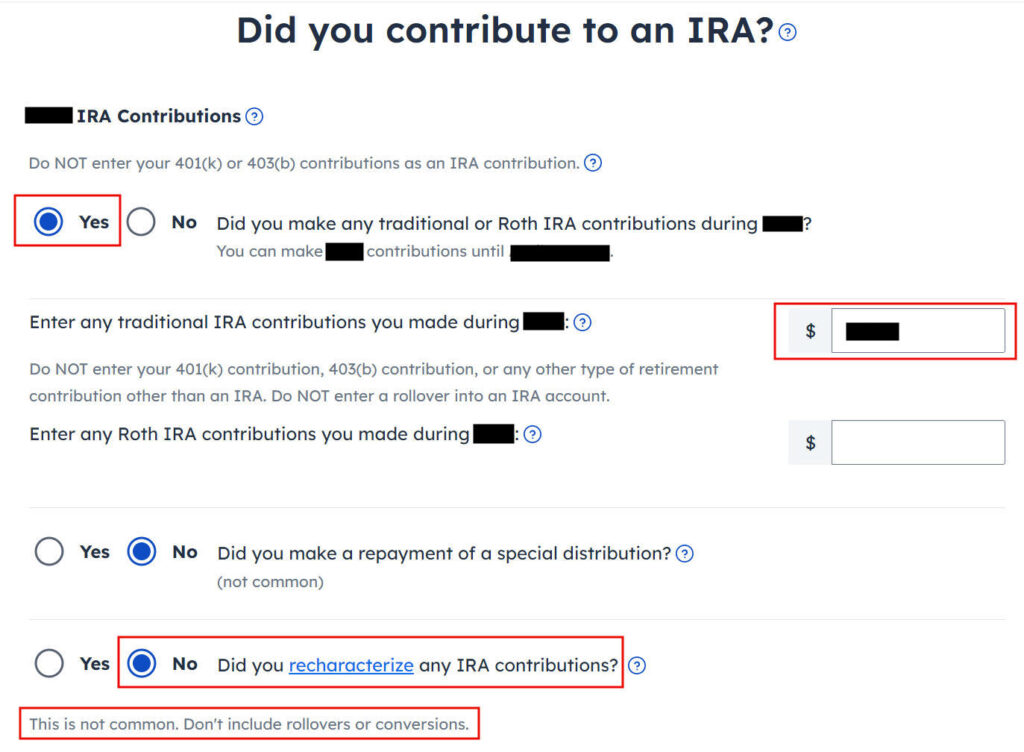

Answer “Yes” to the first question and enter your contribution to your Traditional IRA. Leave the answer to “Did you recharacterize” at No. We contributed $6,500 in our example.

Your refund number goes up again after you enter the contribution.

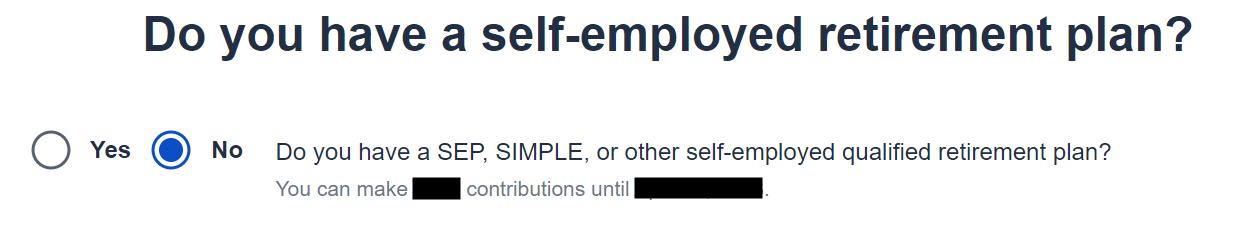

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

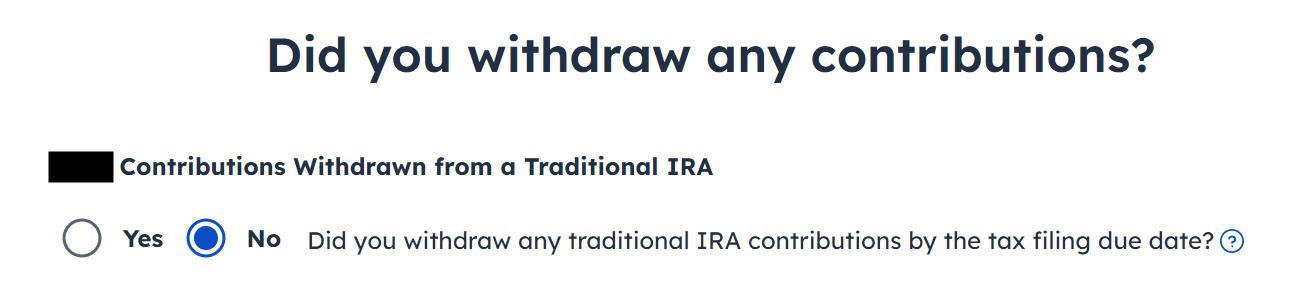

“Withdraw” means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

FreeTaxUSA shows the same page we saw before in the conversion section. Confirm and continue.

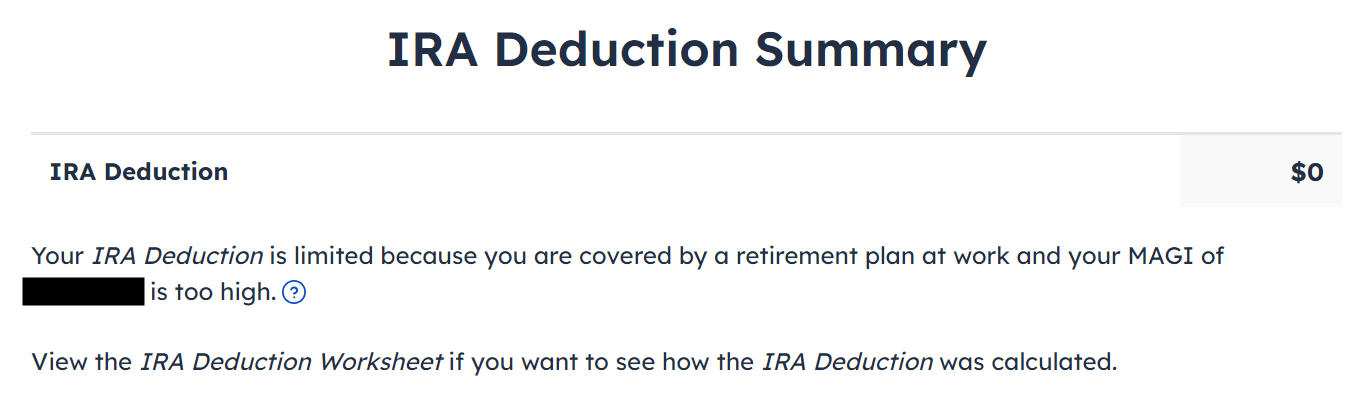

It tells us we don’t get a deduction because our income is too high. If you see a deduction here it means the software thinks your income qualifies for a deduction, which may or may not be correct. Please see the Troubleshooting section.

Taxable Income

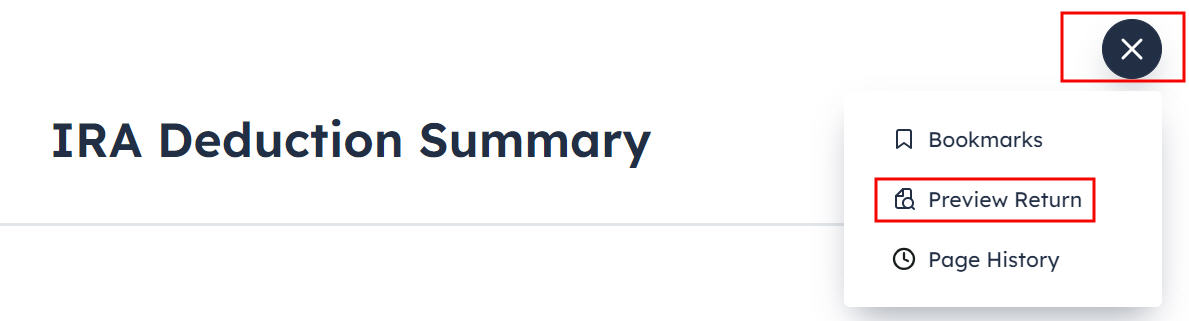

You’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

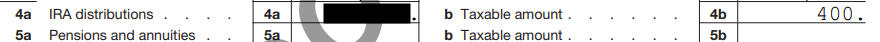

Look for Lines 4a and 4b in your Form 1040.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount on Line 4b would be zero if you didn’t have any earnings.

Go toward the end in the pop-up to find Form 8606. It shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 6,500 (only if you also did a “clean” backdoor Roth on top, otherwise blank.) |

| 2 | 6,000 |

| 3 | The sum of Line 1 and Line 2 |

| 5 | The same as Line 3 |

| 8 | The amount on your 1099-R with a code 2 or 7 |

| 13 | The same as Line 3 |

| 14 | blank (or a small amount if your Traditional IRA had a small balance at the end of 2023) |

| 16 | The same as Line 8 |

| 17 | Line 3 minus Line 14 |

| 18 | The difference between Line 16 and Line 17 |

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries in FreeTaxUSA to make sure they match the W-2.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

[ad_2]