[ad_1]

Here are some facts and figures about the S&P 500:

- According to Global Financial Data, the S&P only contained 90 stocks when it was created in 1928.

- It became the S&P 500 in 1957. At the time, the index was comprised of 425 industrial stocks, 60 utilities and 15 railroads.

- Financials and transportation stocks weren’t added until 1976.

- In the late-1980s, the index was finally revamped to account for the more modern U.S. economy.

- Today, the market cap of the S&P 500 is rapidly approaching $50 trillion.

- The top 10 stocks alone are worth nearly $17 trillion or more than 35% of the total.

- The top 25 stocks account for 48% of the market cap.

- Six stocks are worth more than $1 trillion: Microsoft, Apple, Nvidia, Google, Amazon, and Facebook (these six companies are 29% of the index).

- The tech sector makes up roughly one-third of the index but is likely bigger than that when you consider the companies included in the Communication Services (Google, Facebook and Netflix) and Consumer Discretionary (Amazon) sectors.

- The S&P now makes up nearly 40% of global equity market share (it was more like 20% heading into the 2008 financial crisis).

The S&P 500 is a big part of the U.S. economy but there are plenty of differences between the stock market and the economy.

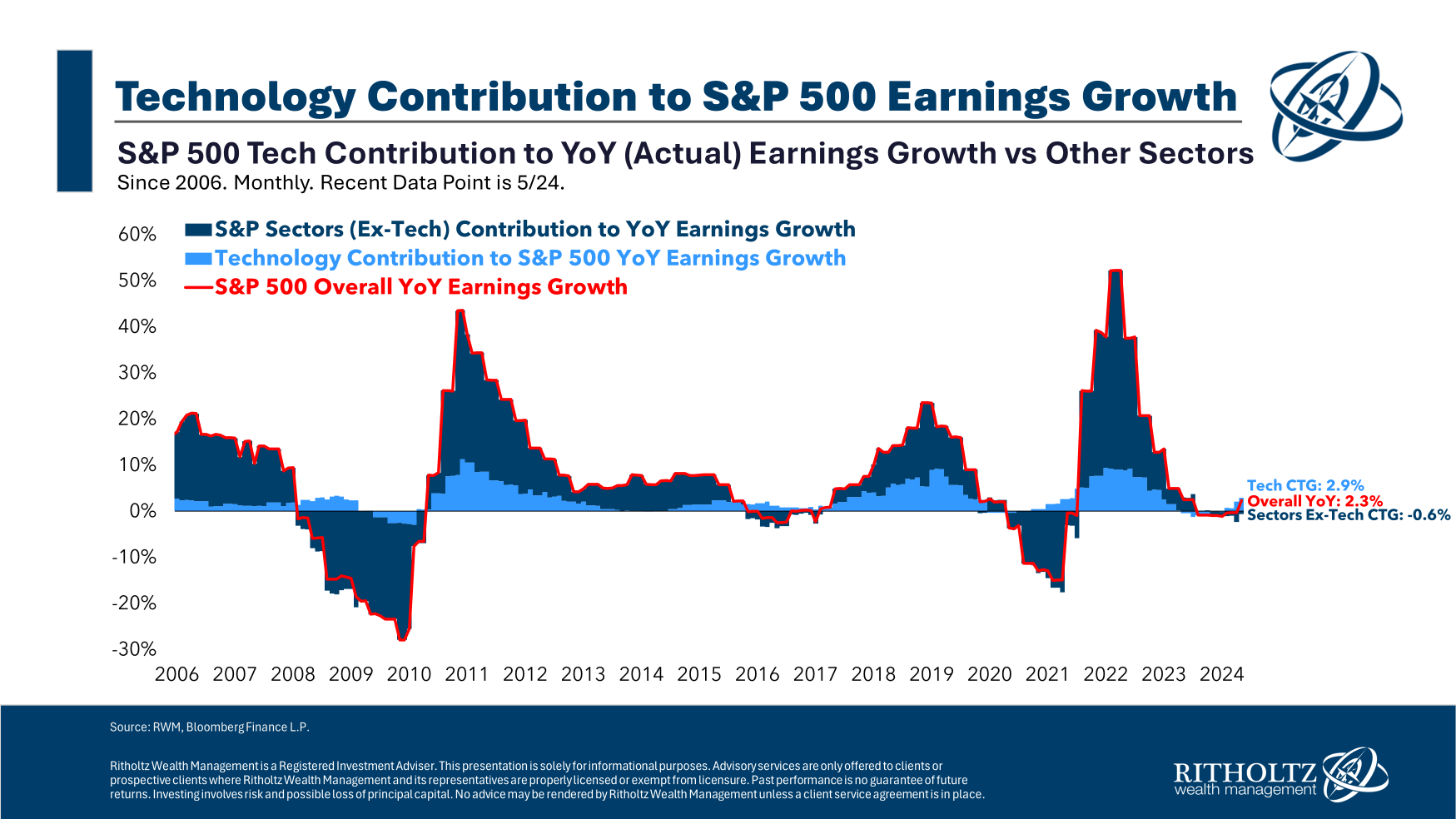

For instance, the technology sector has an outsized impact on S&P 500 earnings growth over time:

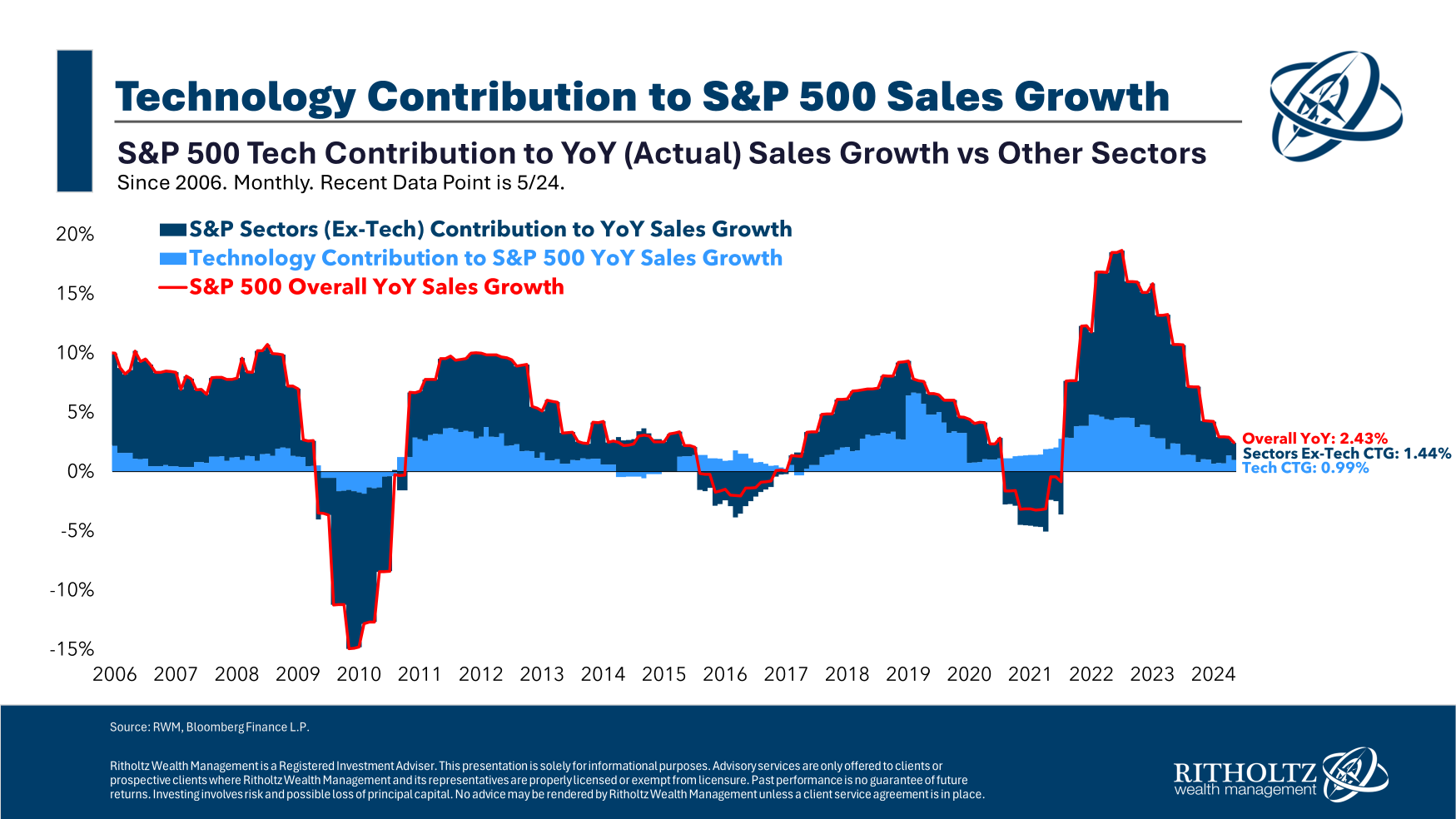

Depending on the time frame, the tech sector can make up the majority of both earnings gains and losses. The same is true of sales:

The BEA estimates tech’s contribution to GDP to be 10%.1 That’s still close to $3 trillion but the economy is far more diversified and spread out than the stock market.

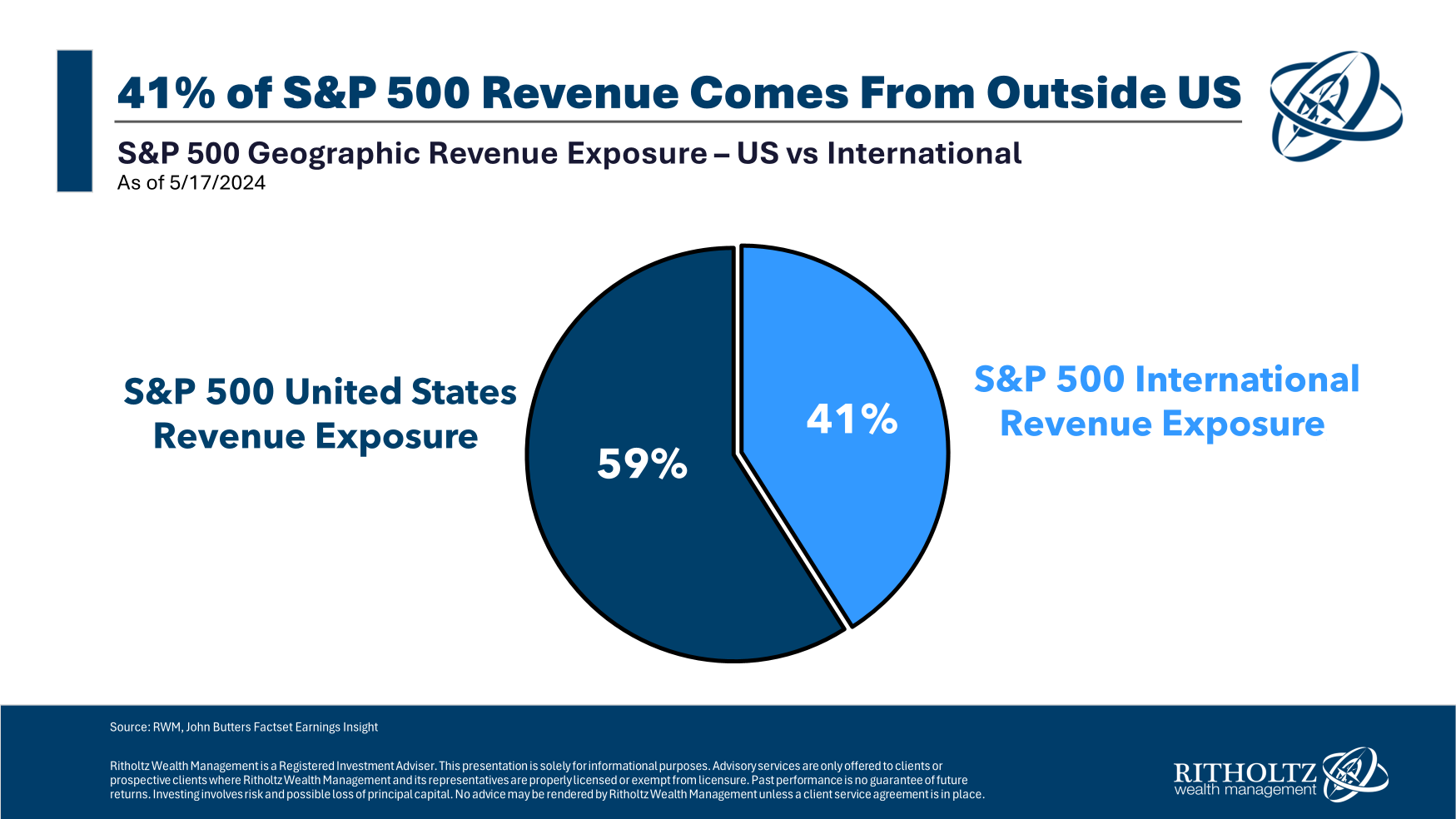

A decent chunk of sales for S&P 500 companies also comes from outside our borders:

The S&P 500 is a U.S. index but it is comprised of global corporations.

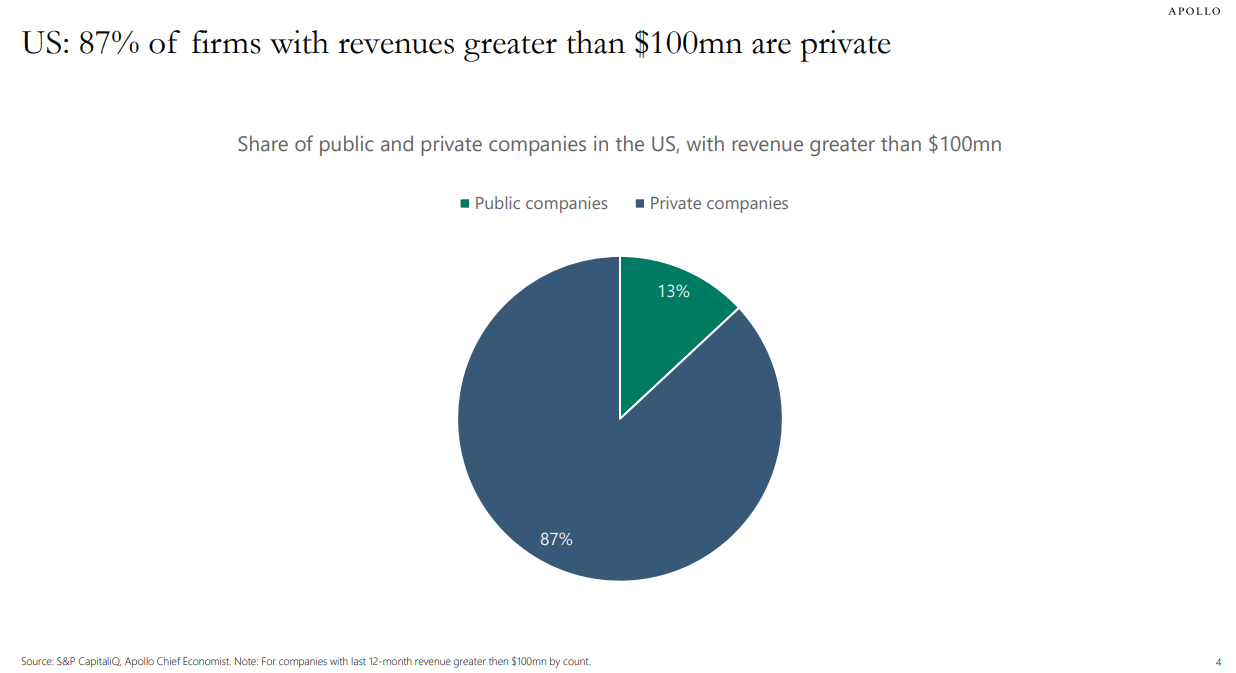

Apollo’s Torsten Slok has some excellent charts that highlight the differences between the stock market and the economy.

S&P 500 companies are enormous but the majority of firms with $100 million or more in sales are private companies:

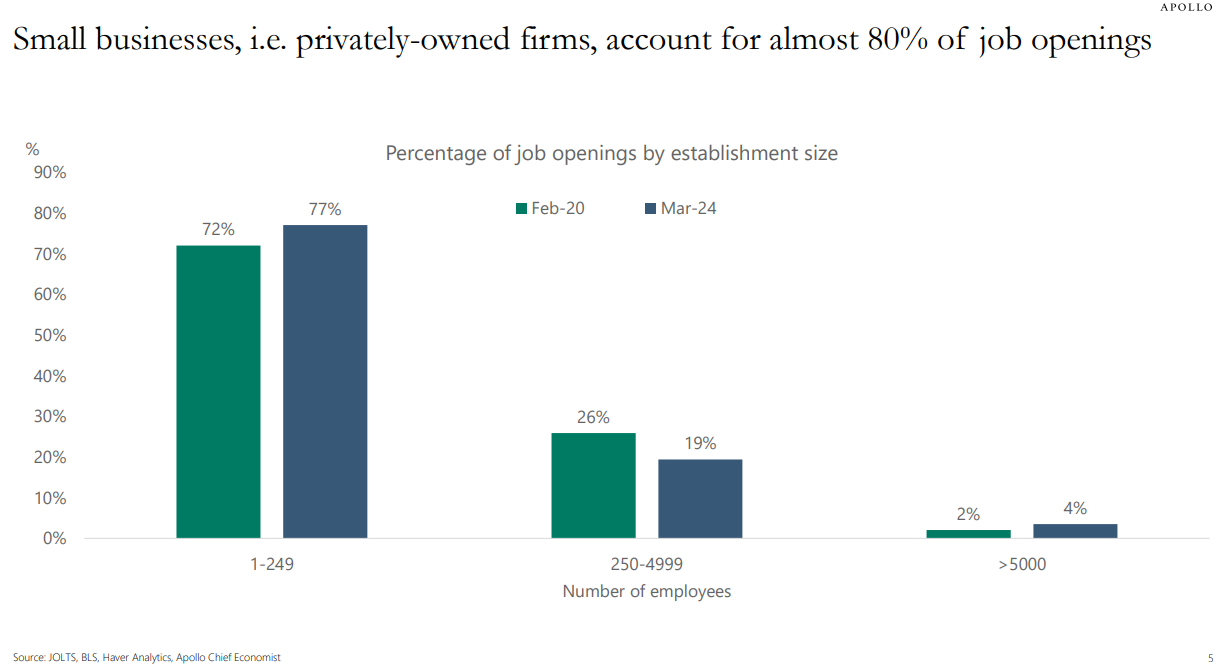

Most of the job openings come from smaller, privately-owned businesses as well:

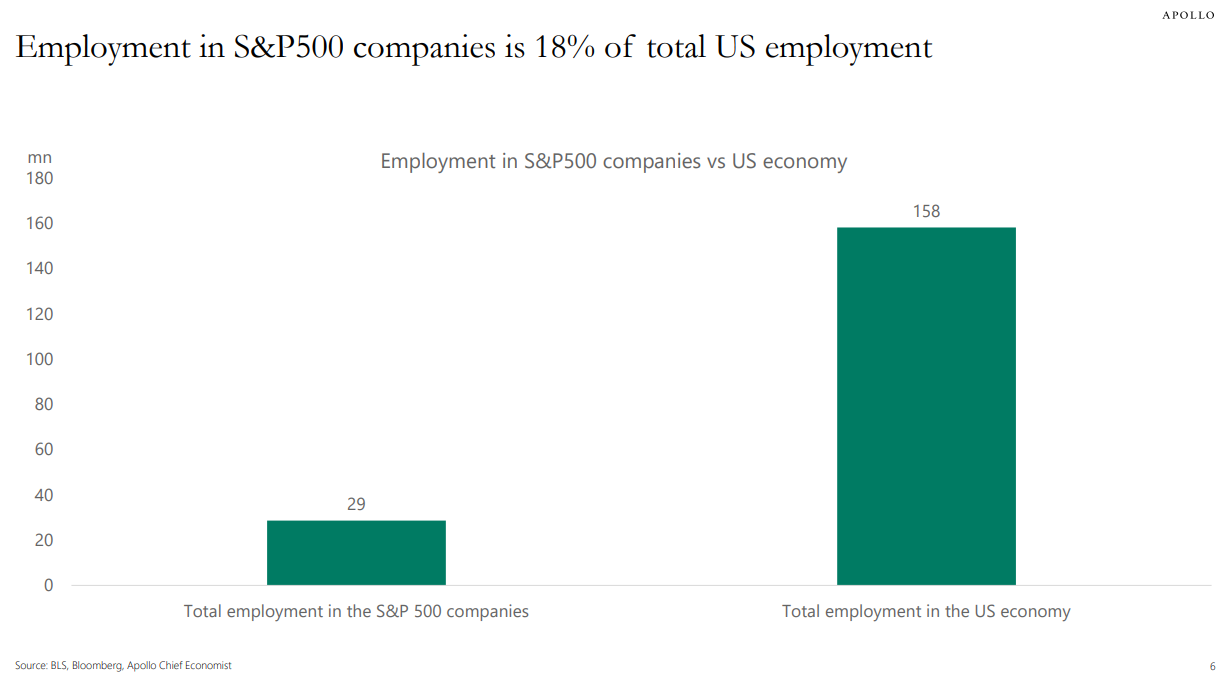

S&P 500 companies account for roughly 1 in 5 jobs in the United States:

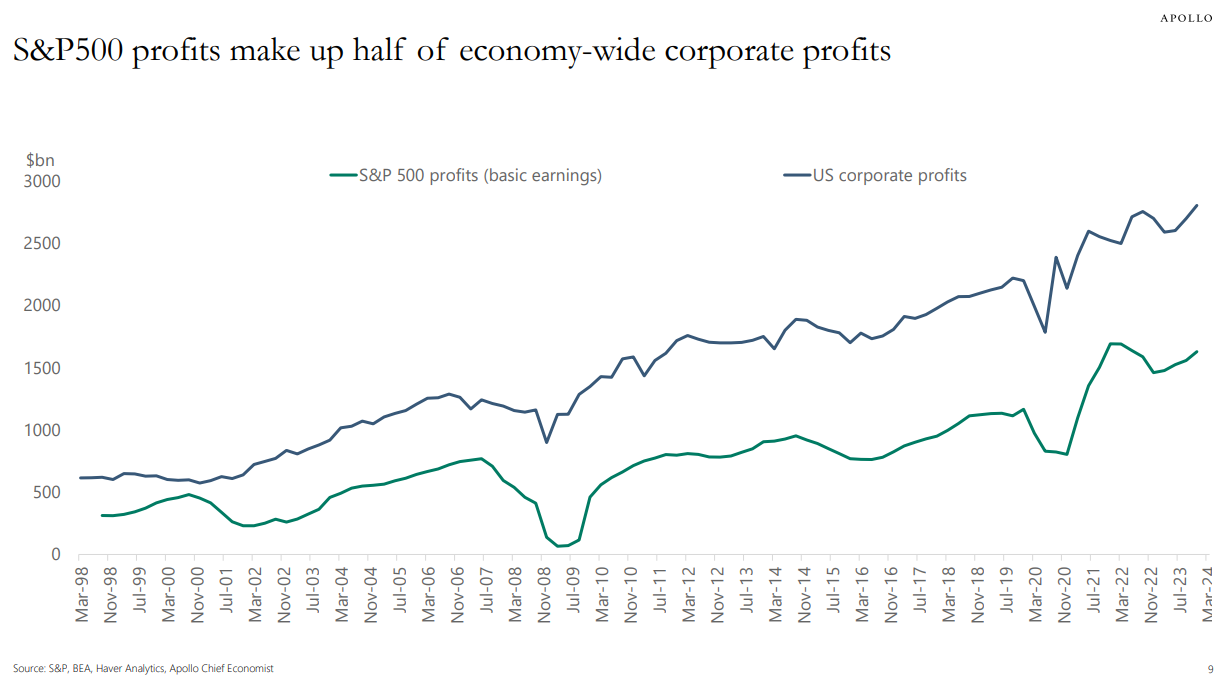

But these corporations are insanely efficient and profitable, accounting for half of the profits in America:

Sometimes the stock market follows the economy. Sometimes the market front-runs the economy. Sometimes the market rises or falls even when the economy doesn’t.

If you ever find yourself thinking that the stock market doesn’t make a lot of sense that’s because sometimes it marches to the beat of its own drummer. At times that drummer is a raging lunatic.

The stock market and the economy need each other but they’re different animals.

Michael and I talked about the S&P 500 vs. the economy and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

What’s Driving Stock Market Returns?

Now here’s what I’ve been reading lately:

Books:

1You could probably quibble with this number since tech is now so ingrained in everything we do.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

[ad_2]