[ad_1]

Last week, the SEC (finally) gave its stamp of approval to spot bitcoin ETFs, with nearly a dozen fund managers launching funds in the wake of the ruling.

This brings up a few questions:

- What is a “spot” ETF?

- Wait, I thought there were already bitcoin ETFs?

- Why is this a big deal?

- Is Monument using bitcoin or bitcoin ETFs in my portfolio?

- Where else can I read about this?

What is a “spot” ETF?

“Spot” simply means that a fund owns the underlying asset, versus ownership in futures contracts or through some other synthetic means. For example, S&P 500 ETFs own the underlying S&P 500 stocks and gold ETFs own physical gold. But many other commodity ETFs operate as futures-based funds, including those that invest in things like oil and agricultural commodities. Also worth noting here, there is a futures-based bitcoin ETF, which launched in October 2021.

So, in short this means that the spot ETF fund owns the actual bitcoin at today’s price, not bitcoin contracts at a future price.

Wait, I thought there were already bitcoin ETFs?

Yes. Kinda-sorta. But only one (outside of the futures-based fund mentioned in the previous section).

For a long time, if you wanted to own bitcoin without going through a crypto exchange, the only game in town was Grayscale’s bitcoin “trust.” Spot? Yes. Exchange-traded? Yes. An exchange-traded fund (ETF)? Technically, no.

The devil in the details resides in this last bit.

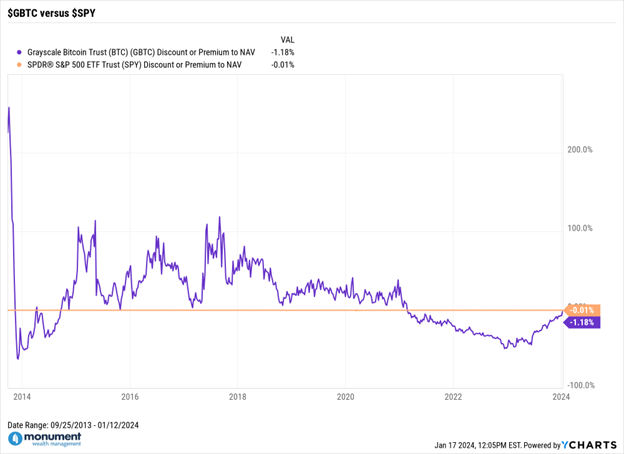

If you had a brokerage account, you could buy the Grayscale fund ($GBTC ) like any other stock or ETF, and Grayscale would take care of things like custody, tax and other reporting requirements. Of course, you couldn’t send or receive bitcoin for transaction purposes, but you had a way to directionally participate in the price of bitcoin. But because the Grayscale fund did not have the traditional ETF structure and “plumbing”, the relationship was not 1-for-1, and wild mispricing would occur, as illustrated by the following graphic.

Very simply: if $GBTC held $100 worth of bitcoin, the fund might trade as though it held as much as $200, or as little as $50. As an investor, the former would be fun, and the latter would be hell. And all along, if your goal was simply to track the price of bitcoin, the experience was a disaster. $GTBC in its original structure (technically a “closed end fund”) was not great at tracking the underlying price of bitcoin (see the purple squiggly line above). But again, for traditional brokerage investors, this was really the only way to participate before last week’s rollout of spot ETFs.

To show how imperfectly the Graysale fund operated, I’ve overlayed the same discount/premium metric for the most popular S&P 500 ETF in the graphic above. The flat orange line illustrates that, over the same time frame, the ETF tracking the underlying S&P 500 Index did so almost perfectly. Owing to the unique creation/redemption process available to open-ended, SEC-approved ETFs. And that’s what last week’s SEC ruling has made available to bitcoin funds, including $GBTC, which converted to the open-ended ETF structure. Going forward, whatever the price of bitcoin does, one would expect the purple line for $GBTC and other “spot” funds to remain as close as possible to the zero line.

For those curious, here are the 11 funds that launched the day after the SEC’s ruling. Two things: first, this is not an endorsement of any fund – you need to THOROUGHLY research these for yourself to determine their appropriateness if you are considering an individual purchase. Second, this includes only newly launched or converted “spot” funds, including $GBTC. Not included here are futures-based funds like ProShares $BITO, which – as noted earlier – launched in October 2021.

Why is this a big deal?

Wide-spread adoption. This fully opens bitcoin (and potentially other tokens) to a broader base of advisors and investors. Many believed that the Federal government wanted to rid the world forever of crypto, especially in the wake of the fraud that was uncovered in 2021 and 2022. Obviously, that didn’t happen, and now, anybody with a brokerage account can buy bitcoin and not have to worry about wallets, storage (custody) or weird tax reporting.

You obviously can’t transact with bitcoin by owning it in an ETF, but if you believe that it’s a store of value or a good speculative asset, then access to these ETFs is a big development. Oh, and with so many funds coming to market, fees are likely to come down in a hurry. When $GBTC was the only brokerage product available, Grayscale could get away with 2.00% internal expense ratios. Thanks to the SEC’s ruling, new funds are coming to market with significantly cheaper expenses, with some products starting at 0.20%. Again, do your due diligence.

Is Monument using bitcoin ETFs in my portfolio?

No, Monument does not currently utilize bitcoin in any capacity, although we certainly reserve the right to change our minds. If and when we do, you can expect abundant communication from us. Like any security that gets added to one of our managed portfolios, we will look at the data vs. our emotional opinion.

Where else can I read about this?

The best writing on this space belongs to Matt Levine at Bloomberg. If you read nothing else about this topic, give this opinion piece a look.

[ad_2]